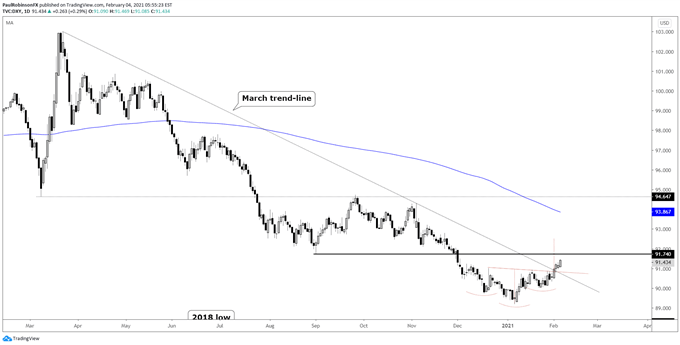

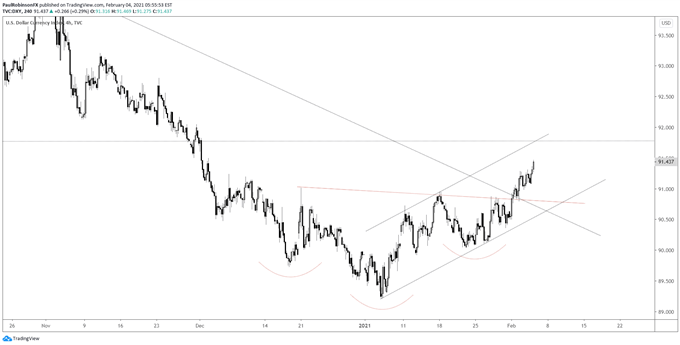

The other day the US Dollar Index (DXY) trigged the inverse head-and-shoulders pattern while also trading above the March trend-line. This has the upside intact, although momentum is a bit of a concern. That could change, then again it might not. In any event, there is an upward channel developing off the Jan low that traders can use as a guide. Stay above the lower parallel and the trend remains near-term neutral to bullish, but break below and the broader downtrend since March may resume. Big resistance lies ahead at the Sep low of 91.74, a level that will of course be of interest should we soon see it. How price action plays out there could go a long way towards how the medium-term trend plays out.

DXY Daily Chart (Sep low ahead)

DXY 4-hr Chart (out of inverse H&S, channel as a guide)

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX