US Dollar, EURUSD, GBPUSD, USDCAD, USDJPY Price Analysis

- It was a big week for volatility and next week brings the FOMC.

- The US Dollar will likely remain in the spotlight around the Fed’s next rate decision.

- EUR/USD and GBP/USD both snapped back this week; while USD/CAD sailed up to fresh four-year-highs.

US Dollar Goes on a Wild Ride

Global markets have went on a wild ride this week and with an FOMC rate decision on the calendar for next week, the door seems to be open for more. While the bulk of the attention was on stock and bond markets putting in historic moves, the FX-space exhibited considerable volatility, particularly in US Dollar pairs after a flight-to-quality drove a big move of strength into the Greenback.

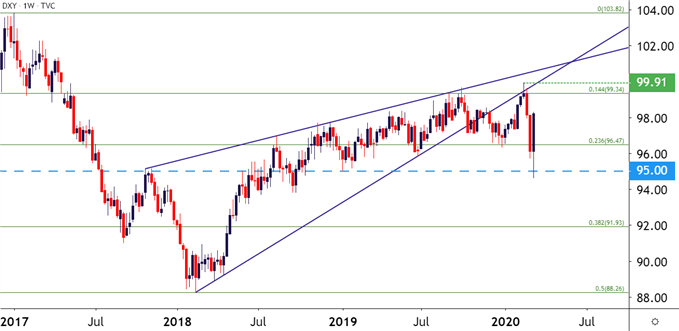

The US Dollar came into the week on its back foot after starting to sell-off in late-February along with US equities. USD even trickled-lower on Monday, soon running into the 95.00 level on the DXY chart to set a fresh yearly low just a few weeks after setting a fresh two-year-high. But that’s around the point that the selling stopped and a massive rally developed on Tuesday and continued through Wednesday and Thursday until the Fed eventually stepped-in, announcing a large injection of capital into the repo market. That stalled the move for a bit; but buyers have merely stepped back-in to prod the rally in the Dollar back up to the 98.00 level on the chart.

US Dollar Weekly Price Chart

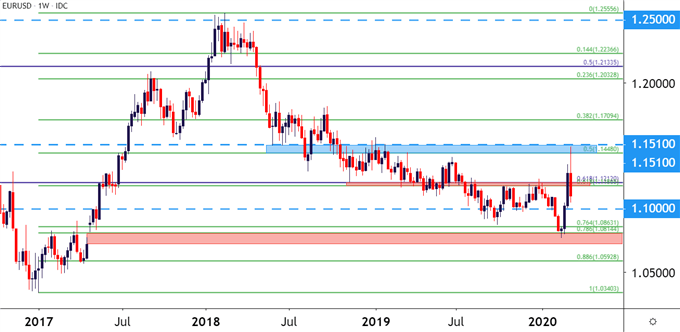

EUR/USD Reverses from Resistance, Hastens During ECB

Yesterday’s European Central Bank rate decision seemed to do little to help the sell-offs, even as the ECB announced an extension of stimulus. They did avoid cutting rates deeper into negative territory, however, and this left some considerable questions around the Euro-Zone economy after Christine Lagarde warned that they may be facing a 2008-like crisis as created by the coronavirus.

| Change in | Longs | Shorts | OI |

| Daily | -17% | 6% | -7% |

| Weekly | -22% | 17% | -8% |

On Monday of this week, EUR/USD surged into a big zone of resistance that runs from 1.1448-1.1500. The former of those prices is the 50% marker of the 2017-2018 major move and was last in play a year ago when helping to set a swing high in March of 2019. The pair moved down to a low of around 1.1054, marking a reversal of more than 400 pips in the past few trading days. The 1.1000 level looms large as potential nearby support.

EUR/USD Weekly Price Chart

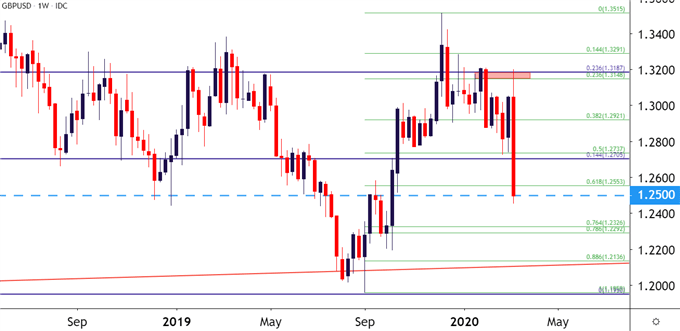

GBP/USD: Cable Collapses as BoE Joins the Rate Cutting Chorus

The Bank of England also announced an emergency rate cut of 50 basis points, helping to prod the British Pound lower after GBP/USD jumped into a key zone of resistance on Monday of this week. Support at this point appears to be coming in from around the 1.2500 psychological level; helping to cap the sell-off in the pair as a very strong US Dollar took over in the latter portion of this week.

| Change in | Longs | Shorts | OI |

| Daily | -14% | 3% | -7% |

| Weekly | -18% | 23% | -4% |

GBP/USD Weekly Price Chart

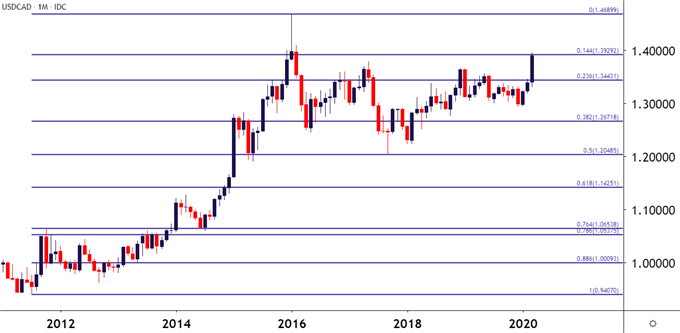

USD/CAD Jumps to Fresh Four-Year-High

As the US Dollar was selling off over the past few weeks, there was one currency of note that was showing even more weakness, and that was the Canadian Dollar. USD/CAD continued to gain even as DXY was falling down to fresh yearly lows; and after starting this week with a large gap buyers continued to push the pair higher.

| Change in | Longs | Shorts | OI |

| Daily | 6% | -11% | -5% |

| Weekly | 12% | -18% | -8% |

At this point, USD/CAD has set a fresh four-year-high and is seeing a bit of resistance at the 14.4% retracement of the 2011-2016 major move. Just above current price action is another area of potential resistance, as taken from the 1.4000 psychological level that hasn’t been traded at since January of 2016.

USD/CAD Monthly Price Chart

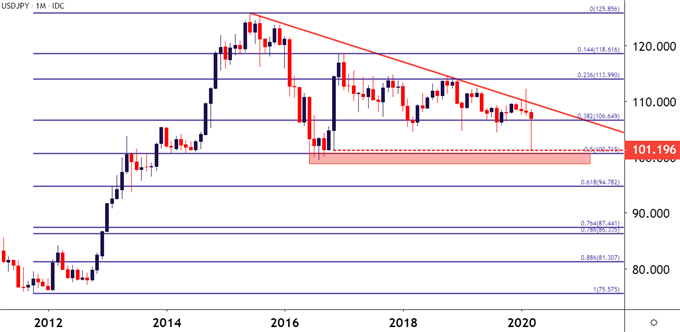

USD/JPY Dips then Rips as Risk Flows Dominate

The week started with fear as USD/JPY fell down to fresh three-year-lows, eventually finding a bit of support around a prior price action swing at 101.19. This was followed by an even more aggressive rip-higher, with the weekly bar currently showing a gain in the pair.

| Change in | Longs | Shorts | OI |

| Daily | 3% | 0% | 1% |

| Weekly | -6% | 3% | 2% |

The monthly chart in USD/JPY is of interest as the lower-highs of the past five years are now running into a horizontal zone of longer-term support, plotted around the 100.00 level in the pair. With the BoJ potentially investigating stimulus options, as well, there’s the potential for Yen-weakness to enter the equation in a very visible manner. But USD/JPY bulls first have to break the recent string of lower-highs before longer-term bullish trends may come back into order.

USD/JPY Monthly Price Chart

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX