US Dollar Index (DXY) Talking Points:

- US Dollar Index Technical Analysis: DXY failed at resistance, risk of base > 90.60

- FOMC Minutes provide opportunity for bullish catalyst, though few seem to stick

- Trader Sentiment Highlight from IG UK: EUR/USD bearish bias from retail favors upside

Despite inflation printing a one-year high on Wednesday, the US Dollar Index (DXY) continues to trade within the daily price range of February 16 when the DXY traded at the lowest levels since 2014. The US Dollar has consistently traded weaker for most of the early days in Q2, and it is getting difficult to find a catalyst that will bring out the Bulls.

While traders will get a closer look at the details of the March Fed meeting with the release of the minutes around the corner, the CPI reports showed traders that hitting inflation expectations wasn’t going to cut it. In other words, the market’s opinion of a marginally hawkish Fed is diminishing relative to what is already priced in the DXY.

Dollar Index on the Losing Side Of Geopolitical Headlines

Donald Trump is overly active on Twitter with geopolitical threats and many US Dollar bulls probably wish he’d put his phone down. As threats rain from his Twitter account, there continues to be the flattening of the US 2/10 yield curve, and concerns that the US may have difficulty in funding its dual deficit as the fiscal stimulus is yet to truly get under way.

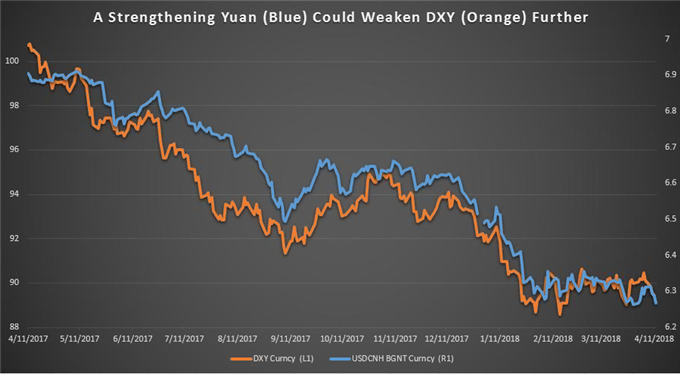

Another possible catalyst on the geopolitical screen that could cause US Dollar weakness is the recent speech by Chinese President Xi Jingping that may set off a new wave of Yuan demand that could lead to US Dollar selling. As USD/CNH continues to push to the levels last seen during the 2015 devaluation, the US Administration is likely quietly applauding the weaker US Dollar that could help international US firms that deal in goods whose main suppliers have been subject to sanctions.

Strengthening Yuan May Pave Way for DXY Weakness

Data source: Bloomberg

Traders should keep an eye on Yuan strength as it may very well set the stage for the next leg of US Dollar weakness.

DXY Technical Update – Daily Chart Shows Price Approaching Resistance

Chart Source: Pro Real Time with IG UK Price Feed. Created by Tyler Yell, CMT

Since Wednesday, January 24, the US Dollar Index has effectively traded sideways. Hedge funds have reduced their US Dollar short positioning with a net-long exposure at 53% of the 52-week range per the CFTC commitment of Traders Report.

Despite the reduction of short-positions, the burden of proof remains on the DXY bulls as the shorts could easily re-engage their short positions should the key support of the February 16 daily range fail to hold up price. The daily range of February 16, which is the current extreme bearish day for 2018 thus far is 87.94-88.92. A close below this zone would show that the multi-month consolidation is likely over and the 14% drop from the high in early 2017 is likely set to continue.

Recently, I put together an Ichimoku-focused report that highlighted the US Dollar available here

Only a close above 90.20, the April opening range high would my bias shift from broadly bearish to neutral. Until then, the US Dollar short trade appears to have multiple supporting factors that are not diminishing.

Traders not wishing to play the index may want to look at stronger currencies within the G10 right now such as the Canadian Dollar, British Pound, or Euro.

Unlock our Q2 forecast to learn what will drive trends for the US Dollar through 2018!

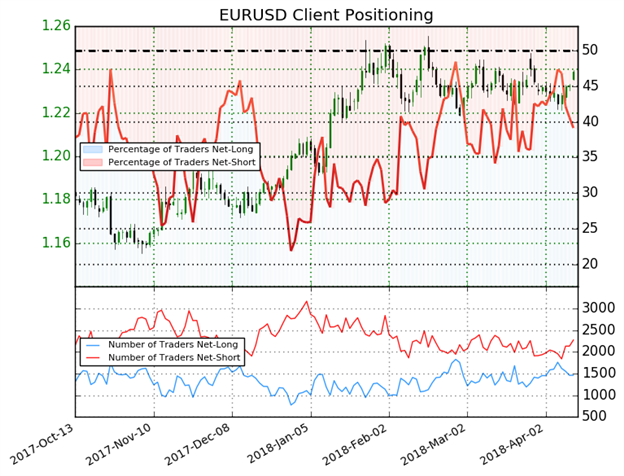

Insight from IG Client Positioning: Traders are Net-Short Suggesting EURUSD May Rise

EUR/USD sentiment is analyzed for insight since EUR/USD makes up 57.6% of DXY.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bullish contrarian trading bias.

New to FX trading? No worries, we created this guide just for you.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell

Join Tyler’s distribution list.