To receive Tyler’s analysis directly via email, please SIGN UP HERE

US Dollar Index (DXY) Talking Points:

- US Dollar Index Technical Analysis: DXY may have room to recover if EUR weakens further

- Hedge funds caught ‘all-in’ on DXY drop as price rebounds remains key upside risk

- Trader Sentiment Highlight from IG UK: EUR/USD bearish bias from retail favors upside

There is a popular adage that markets will do what they need to do to disappoint the most people at any one time. The recent USD outperformance has helped that adage ring true and most notably against commodity currencies like the Canadian Dollar and Australian Dollar as well as the EUR.

EUR/USD At 57.6% of DXY Weight Sets Up For Key Move

Traders are unsure what’s next for EUR/USD. The Bullish view is that the recent 275 pip pullback is nothing but a bump on a Bullish Journey to 1.2630, and potentially 1.2931. Such a move would align with an aggressive breakdown in DXY that would test and break the recently tried and held the support of 88.28 and 87.94.

However, the reversal view on EURUSD that is prudent to consider would be a breakdown of the February low at 1.2205 that could bring a test of 1.2033, the 23.6% retracement of the January ’17 to February range that traveled from 1.0340 to 1.2556. The 1.2000 level also aligns with the 100-DMA.

An inability for this 1.2000 level to hold would open up the view of a broader breakdown on relatively significant USD-strength that could bring a test of the 38.2% retracement of the same range at 1.1708.

A Crowded Trade Gets an Unwelcome Test

Institutions are known as smart money, but they often get caught crowded into popular trades that are quick to reverse. One of those is the play of selling the US Dollar. Per Bank of America Merrill Lynch, the short US Dollar trade is the second most crowded trade second to bullish US equities and the most crowded FX trade.

The short-term outlook has seen focus turned to the concerns of the US fiscal expansion late into an economic cycle and the view that other major central banks normalization anticipation will drive up their currencies, and keep global capital flows as limiting USD upside.

A recent spike in the VIX on February 06 was unable to lift the US Dollar, which has caused some institutions to doubt a probable scenario that lifts the dollar. At the same time, a recent pull-back from record bullish exposure on EUR per the CME futures data suggests that it will take a lot for the institutions to throw in the towel on their bearish USD view.

A recent FX forum in Miami, TradeTech FX, had bank strategists calling for extensive US Dollar weakness with calls of 1.35-1.43 EUR/USD by year end, which would likely see DXY sub-80 to 78.78, which is the 76.4% retracement of the 2008-20017 range in DXY.

DXY Technical Update – Daily Chart Shows Price Approaching Resistance

Chart Source: Pro Real Time with IG UK Price Feed. Created by Tyler Yell, CMT

On February 16, the Dollar Index posted a Bullish Key Day. The pattern requisite is a price low that breaches the prior day’s low followed by a close above the prior day’s high. What’s more is that the Bullish key day aligned with a double-bottom against 88.45, the January low.

The bounce will look to the 38.2% Fibonacci retracement of the December-February range at 90.53 and the February 9 high at 90.56. As mentioned earlier, a break and close of February-high resistance could cause an aggressive unwind of the crowded short dollar position. The unwind could give surprising fuel to the upside up to the 50% retracement of the same price range at 91.23 followed by the 2018 opening range high that was traded at intraday on January 9 at 92.27.

A hold of 90.53/46 on a closing basis in light of the overall bearish momentum picture should encourage traders to heed the impulsively bearish momentum at present and continue to favor further DXY downside until resistance breaks.

Weekly DXY Chart Shows Channel Support Base May Have Formed

Chart Source: Pro Real Time with IG UK Price Feed. Created by Tyler Yell, CMT

The next focal level will be a trendline drawn off the 2011 and 2014 lows that currently holds at 8,880. The current price of US Dollar Index is trading near this level, and a further breakdown and weekly close below this zone would further embolden the bears to keep selling pressure going.

The dollar’s struggles are not going away and flow into other economies argues that USD weakness will persist. While there were arguments for short-term USD strength, they continually failed to materialize showing that pressure remains and US Dollar Index weakness remains preferred.

Short-term resistance is at the opening range high at 92.27. Below these levels, momentum prevails to favor focusing on the 2013 high and 78.6% retracement at 85/84.87.

Unlock our Q1 forecast to learn what will drive trends for the US Dollar through 2018!

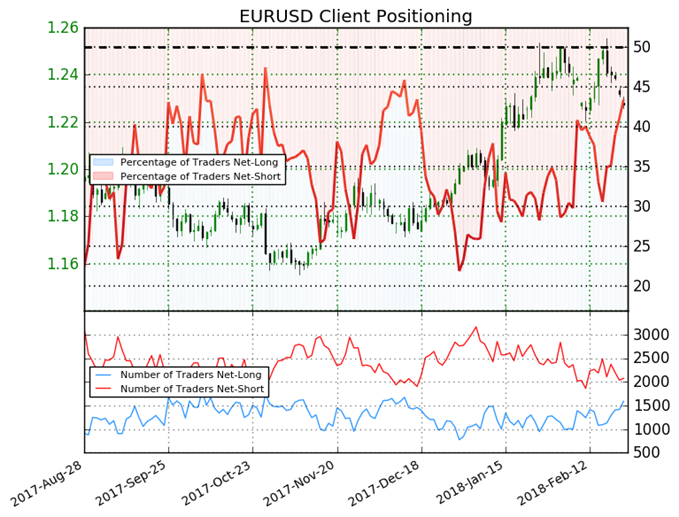

Insight from IG Client Positioning: Traders are Net-Short Suggesting EURUSD May Rise

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.

New to FX trading? No worries, we created this guide just for you.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell

Join Tyler’s distribution list.