To receive Tyler’s analysis directly via email, please SIGN UP HERE

US Dollar Index (DXY) Talking Points:

- US Dollar Index Technical Analysis: Failure to break above 94.20 in Dec. would be worrisome

- Fear of broad drop to close out the year would heighten on break and close below 92.50

- Trader Sentiment Highlight from IG UK: EUR/USD bearish bias from retail weakens

The pain trade of 2017 based on what was expected to transpire and turn trades into profits that never did was the surprisingly weak USD. The US Dollar Index (DXY) played another round of that tune on Wednesday after Janet Yellen gave her last press conference as Fed Chairwoman.

Market Takeaway Is Slightly Less Tightening into the Future

The US Dollar index extended its drop and showed the most weakness against the EUR, which gained 0.67%, the Japanese Yen that gained 0.9%, the Australian Dollar (AUD) that gained 1%, and the New Zealand Dollar, which gained the most against the US Dollar after rising 1.25%. The US Dollar Index itself fell 0.7%, but has yet to trigger sell signals.

The panic button for US Dollar Index bulls likely should not be pushed until a price break and close below 92.50 develops. Above 92.50 (November 27 low), the chart continues to show higher highs and higher lows from the 2017 low traded at on September 08 when the DXY price hit 91.01.

Bye Bye Doves

While traders will no doubt discuss the meaning of the DXY price drop after the Federal Reserve, an important point going forward is who will not be voting next year. Aside from chairwoman Yellen, who will step down in February and succeeded by Jay Powell two other important members who were markedly dovish are leaving. Charlie Evans and Neel Kashkari, both who dissented to the rate hike on December 13 will not be voting next year.

Another takeaway is the Fed is looking to become an increasingly restrictive central bank when looking at Monetary Policy as the rate curve flattens and potentially inverts (short-term yields higher than longer-term yields) in 2018. The long-term median dot of the Dot Plot was 30bps above the long-run median with a majority of participants seeing the long run rate at or above 3%.

Unlock our Q4 forecast to learn what will drive trends for the US Dollar through year-end!

US Dollar Index Price Drops To Trend line Support, Uptrend Still (Barely) Holding On

Chart created by Tyler Yell, CMT. Tweet @ForexYell for comments, questions

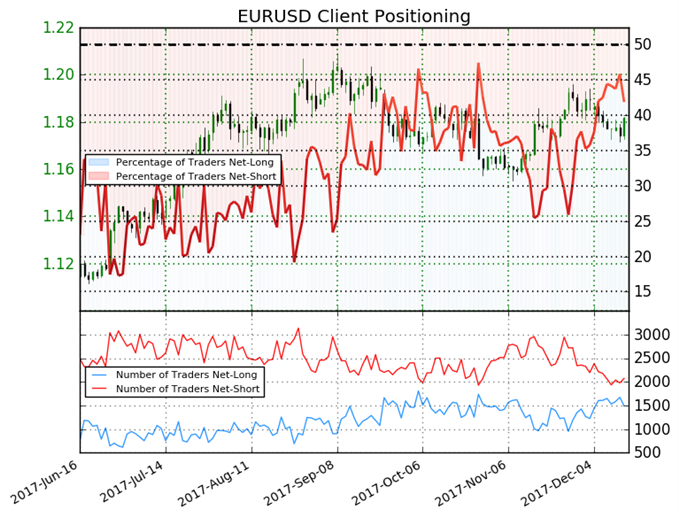

Insight from IG Client Positioning: Pickup in long positioning favors resistance on price advance

EUR/USD sentiment is analyzed for insight since EUR/USD makes up 57.6% of DXY.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bullish contrarian trading bias.

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell