Will King Dollar resume the throne and rise again? Get a free DFX Q2 market forecast here

Talking Points:

- DXY Technical Strategy: DXY in favorable technical set-up for a moderate bounce

- JPY strength in the wake of recent political turmoil also likely to weight on DXY

- EUR strength expected to continue making DXY gains tough to come by

The dollar has been a bit of a whipping boy of late as bad data continues to stack up for the currency that was expected to be the darling of G10FX in 2017. The Dollar Index (DXY) traded at new 2017 lows on Wednesday after concerns grew on whether or not the current US administration would be able to progress their inflation inducing agenda. The hope that had surfaced at the election of President Trump was expected to align nicely with the reduction of accommodation from the Federal Reserve.

For a quick trip to the land of economic theories, traders can dust off their textbooks to locate the Mundell-Fleming model, which helps explain expected the impact on exchange rates in the short-term when monetary and fiscal policies diverge. The hope that Dollar bulls had was that we were about to witness a nice combination of relatively restrictive monetary policy as the Fed hiked rates and mused about reducing their $4.5T balance sheet while the administration led an expansionary Fiscal policy of the world’s reserve currency.

However, we’ve seen bond markets less than confident that the restricting monetary policy efforts fo the Federal Reserve will come to pass in the coming years. At the same time, doubts are growing about how much fiscal policy (infinitely harder to approve than monetary policy in the current framework), will expand given the drama that has surfaced out of the US capital.

Despite the economic models, economic weakness compared to prior expectations and political drama have led to significant DXY weakness, which has helped propel EUR/USD to 2017 highs. Traders looking at the chart should keep an eye on the 3-year Trendline acting as new resistance. The Trendline is currently +100 points away from Thursday's spot at 98.80. An inability for the price to close above 98.80 would favor a continuing trend of DXY weakness toward the November low of 95.89.

If you would be interested in seeing how retail traders’ are bettingin key markets, see IG Client Sentiment here !

Join Tyler in his Daily Closing Bell webinars at 3 pm ET to discuss this market.

DXY trading at levels not seen since Election Day. Weak upside anticipated over reversal

Chart Created by Tyler Yell, CMT

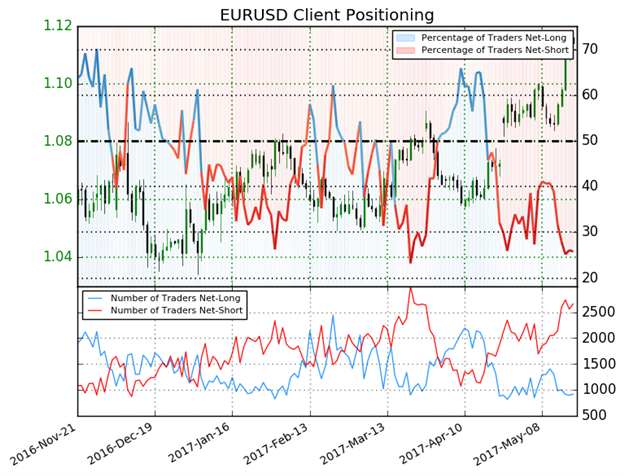

IG Client Sentiment Highlight: EUR (57.6% of DXY) Sentiment Favoring Further Upside

EURUSD: As of May 18, retail trader data shows 26.0% of traders are net-long with the ratio of traders short to long at 2.85 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.06101; the price has moved 5.0% higher since then. The number of traders net-long is 8.7% lower than yesterday and 36.9% lower from last week, while the number of traders net-short is 2.7% higher than yesterday and 29.7% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bullish contrarian trading bias (Emphasis mine)

---

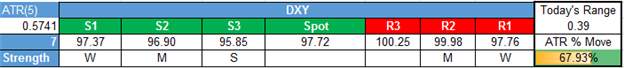

Shorter-Term DXY Technical Levels: Thursday, May 18, 2017

For those interested in shorter-term levels of focus than the ones above, these levels signal important potential pivot levels over the next 48-hours.

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell