To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

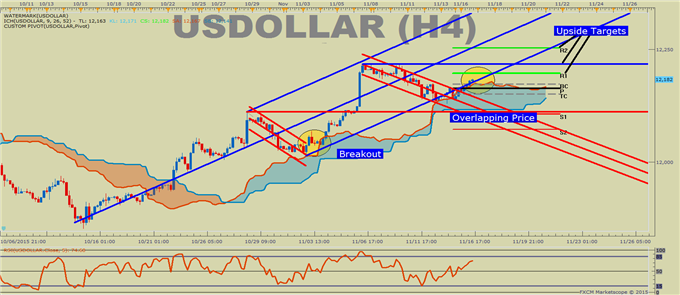

-US Dollar Technical Strategy: US Dollar Favors Buying Dips

- Short-Term Support Zone Held Before Bounce Turning Focus Toward New Highs

-US Dollar Remains Second-to-None Among G10

US DOLLAR is aggressively making its way to the November opening range high of 12,219. The structure of the move higher from the October 15th low has the signs of a strong move into year end unless support surprisingly gives way. Even in the face of weaker retail sales and suspected lower risk sentiment, the US Dollar continues to find favor among FX traders as the anticipation for a Fed rate hike at the December 16th FOMC meeting builds. Additionally, the market is finding a hard time finding a true #2 currency, which typically knocks on the #1 currency in the G10 and takes over when something gives way.

The key structure of the move higher in US Dollar has to do with the lack of overlap on the price chart. Overlap refers to a pullback in an uptrend overlapping a prior price high. While overlapping doesn’t denote a reversal trade, the lack of overlap helps to show how strong the trend is currently. US Dollar saw a strong bounce off the Ichimoku H4 cloud (pictured on the chart below) before overlapping the late October high of 12,110. 12,110 also aligns with the Weekly S1 support that is often strong support in an uptrend as well as the Ichimoku H4 cloud support. Therefore, we would continue to look higher if an overlap fails to develop. The three key upside targets on the US Dollar start with the Weekly R1 at 12,197, followed by the November opening range high of 12,219 and finally, the Weekly R2 Pivot of 12,253.

The US Dollar ended the day higher vs. all G10 peers and closed near the highs for the day. While choppy action tends to be the rule over the exception, until support breaks, it’s likely best to see any short-term weakness as a buying opportunity unless a daily close below support develops. US Dollar has also been supported by other markets like the Treasury yields, and the strong dollar continues to act as a force on many commodities like copper, which pushed to new multi-year lows. Even the JPY was no match for the US Dollar as some thought would be the case due to the tragedy in Paris on Friday. The JPY continued to weaken due to below estimates in GDP seen as increasing the odds of further BoJ QE while the Fed is expected to hike in December.

Would You Like To Know the Traits of Successful FX Traders? If so, Click Here