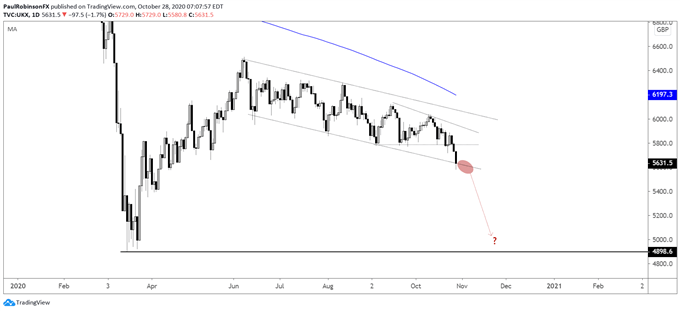

FTSE Technical Highlights:

- FTSE broke wedge, now testing bottom of multi-month channel

- Break of lower parallel anticipated to lead to acceleration lower

- Looking a new low coming soon, possible channel breakdown

The FTSE 100 grind lower may soon come to an end as the trend could begin to accelerate. There was a series of lows around 5780 that forged a wedge, that has been broken. This has the bottom-side of channel dating back to early June in play.

It has been a stubborn structure, or robust, however you want to describe the ongoing channel, and that is why a breach outside would likely see price gain momentum. In this case, bringing the March lows near 4900 into play, or worse.

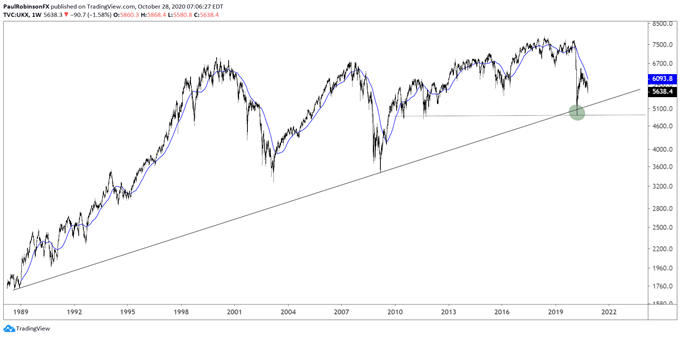

A move towards the March lows would have a trend-line (on a log scale weekly chart) in play from the late-80s. This is where the coronavirus low was found, but with it upward sloping it is now about 300 points higher (~5200).

Perhaps a higher-low is created at the trend-line, or we get a full retest and maybe break of the March low. Hard to say at this juncture, we’ll need to see what is transpiring should the FTSE move to that point.

First, though, the underside parallel of the multi-month channel needs to be broken convincingly, as it has flirted with doing so but has yet to close beneath. For as long as it holds the outlook is still neutral to bearish, but difficult to justify an aggressive bearish bias. Longs don’t hold much appeal at this juncture outside of maybe some quick flips as price could still rebound off declining support.

FTSE Daily Chart (testing bottom of channel hard)

FTSE Weekly Log Chart (long-term trend-line, march lows)

UK 100 Index Charts by Tradingview

Tools for Forex Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX