FTSE 100 Technical Highlights:

- FTSE price action remains unclear after failing near resistance

- Trend-line support from March to watch

FTSE price action remains unclear after failing near resistance

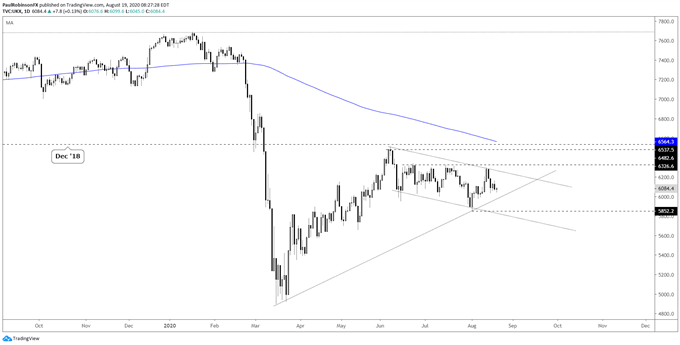

Last week, the FTSE tried to rally, but then ran aground into solid resistance around 6325. This remains a hurdle it needs to cross if it is to continue to try and trade higher out of the chop its been stuck in the past two months.

There is support coming up via a trend-line dating back to the panic days of March, with the line forming as a result of connecting with the August 3 low. It isn’t the sturdiest line of support, but nevertheless the first one to watch for a signs of a reaction off of. Should the FTSE bounce from it then later on it will gain importance.

A break of the tentative trend-line will have in focus this month’s low at 6032 along with a lower parallel from June. This could accelerate a move lower, but in the current environment it might just turn into a modest dip below prior support before bouncing back.

The trend-line off the June high passing over the monthly high is parallel to the line running from the June to this month’s low. This could create a steady channel structure to work with later on if either side is validated as holding technical weight.

For now, the general outlook is towards seeing more choppy trading, which means trading for those seeking a directional move may continue to be difficult.

FTSE Daily Chart (choppy)

UK 100 Index Charts by Tradingview

You can join me every Wednesday at 930 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX