FTSE 100 Technical Highlights:

- FTSE a laggard, expected to remain this way

- New swing-lows could come soon

For our analysts intermediate-term fundamental and technical view on the FTSE and other major indices, check out the Q3 Global Equity Markets Forecast.

FTSE a laggard, expected to remain this way

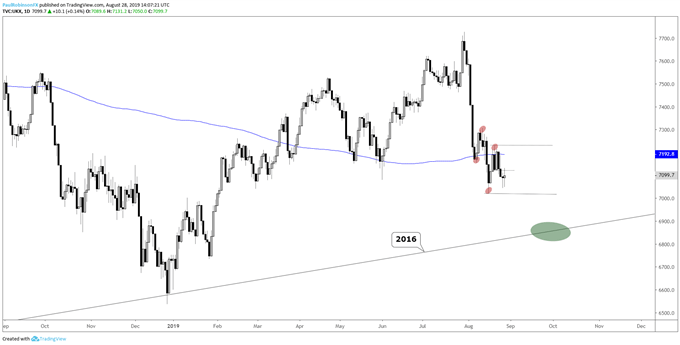

The FTSE continues to be a weak spot, globally, for equities. It currently sits relatively close to the monthly low at 7020. It wouldn’t take much to knock it through. On a break lower the 2016 to current trend-line could quickly come into play around the 6900 level.

It’s a fairly substantial trend-line given it dates back to the major low in February 2016 and crosses under the December bottom. A hold would be critical to keep the FTSE from falling apart further towards last year’s lows or worse.

In the event the market can turn higher it will have its work cut out for it to turn the picture bullish. The 200-day MA has been an important spot in recent trade. It held as support momentarily earlier in the month but more recently turned into a source of resistance. It is seen as unlikely we see much of a move beyond 7231.

Tactically, the bias is for lower prices, however; right here at this moment risk/reward isn’t particularly favorable for new entries. A small move up towards the area around the 200 could offer a more attractive spot for would-be shorts. Longs at this time hold no appeal.

Check out this guide for 4 ideas on how to Build Confidence in Trading.

FTSE Daily Chart (bearish price action expected to continue)

UK 100 Index Charts by Tradingview

You can join me every Wednesday at 930 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX