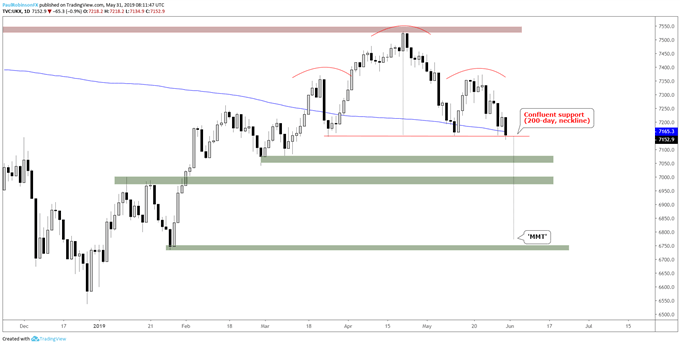

FTSE 100 Technical Highlights:

- FTSE 100 trading at 200-day, neckline of H&S pattern

- Support until broken, but looks quite vulnerable

- Levels to watch should the index break

For the Q2 FTSE & GBP forecasts, check out the DailyFX Trading Guides page.

FTSE 100 trading at 200-day, neckline of H&S pattern

A couple of weeks back we looked at a bearish scenario for the FTSE 100 should it turn lower from resistance – a head-and-shoulders (H&S) pattern. With the recent round of weakness since that time the index is back testing confluent support by way of the 200-day and neckline of the H&S formation.

A daily close below 7146 will have the FTSE 100 triggering the H&S and rolling downhill towards lower levels. The height of the pattern from the head down to the neckline calls for about a 380-point measured move, or a drop to ~6770.

Along this path there are support zones to watch; late-March, early-Feb brought support in the vicinity of 7088/41, below there watch 7001/6968 from January, followed by the measured move of 6770. The measured move target (MMT) is just an approximation without any actual levels backing it, leaving a break below the January swing level open for potential to take the FTSE to a swing low from Jan at 6734.

Tactically speaking, today could be an important day as confluent support and a bearish price pattern could trigger by day’s end. If this is the case, then shorts should gain the upper hand in the sessions ahead. If support holds it will be a prudent move to lay low on shorts, while the chart will still look in need of mending before longs become appealing.

FTSE 100 Daily Chart (at 200-day, neckline)

Check out this guide for 4 ideas on how to Build Confidence in Trading.

You can join me every Wednesday at 9 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX