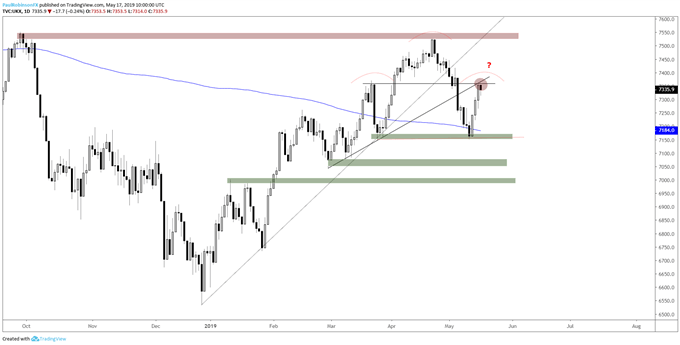

FTSE 100 Technical Highlights:

- FTSE 100 bounced off the 200-day, March swing-level

- Running into minor confluence of resistance

- Possible head-and-shoulders pattern in the mix

For the Q2 FTSE & GBP forecasts, check out the DailyFX Trading Guides page.

FTSE 100 bounced off the 200-day, March swing-level

The FTSE posted a low this week just beneath the 200-day MA right around a swing-low level from late-March. The bounce began just ahead of a bottom in the rest of Europe and the U.S., which was a curious development since the FTSE had been a downside leader the past few weeks.

At any rate, the lift off support has so far been a strong one but is currently in a face-off with resistance arriving by way of a trend-line extending higher from the Feb 28 low and the peak from March 21. Both levels are considered minor, so while there is confluence it isn’t necessarily of the strongest variety.

One bearish scenario is for the development of a head-and-shoulders pattern to form, with the current advance needing to soon reverse course. A reversal would need to lead to an eventual break of the neckline situated across the recent low in order for the pattern to be validated.

In the event we don’t see an H&S pattern fully develop, then how any correction or pullback from here plays out the next few days will be important to watch for as signs of consolidation. A gradual pullback or horizontal correction could give traders reason to continue betting on further upside with a base from which to work with. In this case, the area above 7500 could come into play as the next level of resistance.

All-in-all, in ‘wait-and-see’ mode until further price action provides better clues as to what the next move will be.

FTSE Daily Chart (at a minor cross-road)

Check out this guide for 4 ideas on how to Build Confidence in Trading.

You can join me every Wednesday at 9 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX