FTSE 100 Technical Highlights:

- FTSE 100 trading around the 200-day MA

- Long-term moving average may have limited impact

- Levels to keep an eye on in the coming sessions

For the Q2 FTSE & GBP forecasts, check out the DailyFX Trading Guides page.

FTSE 100 trading around the 200-day MA

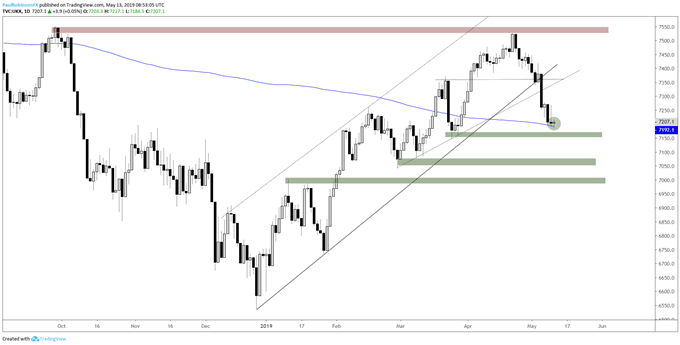

In the last FTSE 100 outlook, the focus was on confluent support via the trend-line from December and March high; a threshold which was easily undercut. This shifted attention towards the 200-day MA, which is now under siege with further escalation in the U.S./China trade war keeping global markets on their heels.

The 200-day MA may not turn out to be a big point of support, but with a swing-low from late-March at 7146 not far below we may see some type of near-term buying activity keep the index afloat. Below the late-March low next up is the 7078/41-area, followed by 7000/6968.

Keep an eye on how other global markets are playing out with the trade war as the dominating theme. The DAX is working towards support around 11800, while the S&P 500 is vulnerable as the rising wedge it recently broke down from projects lower levels ahead.

From a tactical standpoint, very short-term minded traders (intra-day) may want to continue to focus on the short-side with in mind the notion that a bounce could develop at any time. It looks a little late in this particular move to put on a good risk/reward swing-short, but at the same time longs don’t hold any appeal without proper price action yet suggesting the decline could be drawing towards an end.

Should we see a bounce soon, given the sharp break in recent sessions, how it unfolds will be of great interest to watch as a continuation pattern of substance could form and give a good look for new short positions.

Check out this guide for 4 ideas on how to Build Confidence in Trading.

FTSE 100 Daily Chart (trading around 200-day MA)

You can join me every Wednesday at 9 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX