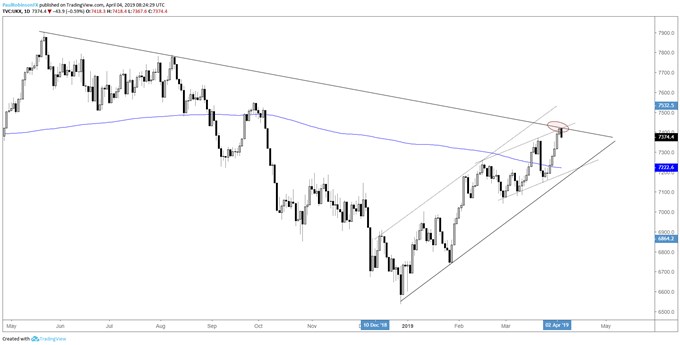

FTSE Technical Highlights:

- FTSE dip leads to rip into trend-line off record high

- May undergo pullback, but still has trend support

For the recently released Q2 FTSE & GBP Forecasts, check out the DailyFX Trading Guides page.

FTSE dip leads to rip into trend-line off record high

It hasn’t been the cleanest rally off the December low, not like the one seen in the U.S., but nevertheless the FTSE continues to carve out higher highs and higher lows. Yesterday’s trade brought the index up to a trend-line off the record high from last year, which may be a bit of a sticking point for the rally.

The trend-line is also in conjunction with a less-important line running over from the February high. We may see some weakness come in here, as we are starting to see this morning, not only because of resistance but also because that has been the pattern in the FTSE – 3 steps forward, 2 back.

With that in mind, as long as the underside of the channel off the December low continues to hold up then so does the trend since then. It will require a turn down and break of the lower parallel before being able to turn aggressively bearish.

Tactically speaking, existing longs may want to button up trailing stops as pullback risk climbs. Fresh longs, until resistance is overcome, don’t hold much appeal. Nimble shorts may look to nibble from the short-side, but without high conviction bearish price action short opportunities will be lacking.

Check out this guide for 4 ideas on how to Build Confidence in Trading.

FTSE Daily Chart (t-line off record high)

You can join me every Wednesday at 9 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX