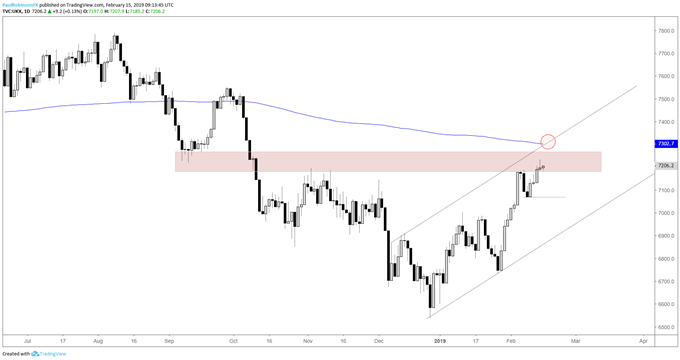

FTSE Technical Highlights:

- FTSE trend since December positive, but obstacles in the way

- Price, slope, and long-term MA arrive in same zone

Get your forecasts today for the FTSE and Pound right here on the DailyFX Trading Guides page.

FTSE trend since December positive, but obstacles in the way

Since bottoming with global stocks back in December the trend for the FTSE has been a bit rough, especially by comparison to the U.S. markets, but nevertheless it’s been positive. This is a bit offset in the short-term, though, by the obstacles that stand in its way from current levels up about another 100 points.

The past couple of weeks the focus has been on resistance in the vicinity just under up to 7200. A pullback from this area developed last week and yesterday a smallish reversal developed after a breakout above last week’s minor peak. Sellers are in the area.

With additional strength it won’t get much easier as the low from September is still problematic, but more importantly the 200-day MA stands in the way even if it can clear the Sept low. In rough confluence with the 200 is a top-side parallel tied to the trend-line off the December low. It’s not the strongest form of resistance given it is angled higher with the market, but the fact it is around the 200 makes it more likely to act as a stopper for higher prices.

For now, respecting the trend higher in the absence of a swift turnaround but also respecting the fact that resistance stands in the way. The combination of positive trend and resistance makes it difficult to have conviction from either direction at this time.

Check out this guide for 4 ideas on how to Build Confidence in Trading.

FTSE Daily Chart (Positive trend, but resistance in the way)

You can join me every Wednesday at 10 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX