Talking Points

- The FTSE 100 opened lower given profit taking, a slide in crude oil prices, and the Shanghai Stock Exchange Composite Index sliding by almost 4 percent.

- The FTSE 100 is now trading below a cluster of resistance levels, starting with the December high of 6447.

- Short-term support is Monday’s swing low of 6261.

- A Bloomberg news survey projects the U.K. ILO Unemployment Rate to remain unchanged at 5.1 percent.

The FTSE 100 (CFD: UK100) opened lower on what appears to be profit-taking following strong gains over the last few days, a slide in crude oil prices following the end of Kuwaiti oil workers’ strike, and the Shanghai Stock Exchange Composite Index sliding by almost 4 percent.

Over 7000 Kuwaiti oil and gas workers had been on strike for three days as they protested against pay cuts and work-related reforms. Because of the strike, crude oil production in OPEC’s third largest oil producer, declined from about 3 million barrels a day to 1.1 million. When news of the end to the strike reached the markets, crude oil prices declined slightly which in turn has affected the share price of FTSE 100 energy firms. The Energy Sector is today’s loser at the time of writing.

Today, the Shanghai Stock Exchange Composite Index was at one point down by 4.68 percent from its session high. There is no strong consensus about the trigger behind the move, but we do note that price traded below the April 8 swing low of 2960, which has ended the sequence of rising swing lows.

The 90-day correlation between the FTSE 100 and Shanghai Stock Exchange Composite Index is at a low of +0.21, but the developments in the Chinese stock index have had strong impacts on worldwide stock markets in the past.

FTSE 100 Technical Overview

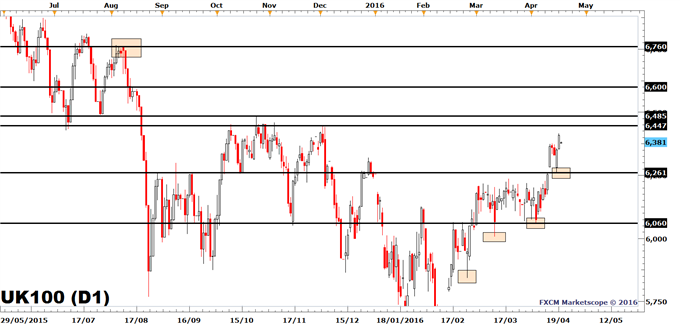

Yesterday, the FTSE 100 stalled as it approached a cluster of resistance levels, starting with the December high of 6447 and ending with the October 23 high of 6485. Beyond the October high, the next major resistance level is the August high of 6760; this level is 4.2 percent higher than the October high and is, therefore, critical for market participants. A short-term resistance level on the way to the August high of 6760 is the August 14 high of 6600.

Monday’s swing low of 6261 remains a short-term support and given that this low is higher than the April swing low of 6060, the short-term trend is bullish. A short-term support level beyond Monday’s low is the April 11 low of 6162.

The U.K. labor market report is on deck today. A Bloomberg news survey projects the ILO Unemployment Rate to remain unchanged at 5.1 percent, while the Jobless Claims Change to print -10K from -18K. Some economists have said that the report may provide input as to the effect of the looming Brexit vote.

Our Stock Market forecasts for Q2 2016 are now live on the site. Download them for free.

FTSE 100 | FXCM: UK100

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00