Talking Points

- The rally over the last 24 hours was motivated by Chinese exports which returned to growth and on JPMorgan Chase reporting earnings which beat analysts’ expectations.

- With a breach to the December 29 high of 6322, the next resistance level ahead of the FTSE 100 is the December 2 high of 6447.

- Monday’s low of 6174 is the most recent swing low and the short-term trend-defining level.

- The Bank of England Rate Decision is on deck this morning and will be followed by U.S. Initial Jobless Claims and U.S. Consumer Price Index this afternoon.

The FTSE 100 (CFD: UK100) has risen swiftly over the last two days and by yesterday’s close, it was up by 3 percent.

In the last 24 hours the rally was motivated by Chinese exports which returned to growth, lifting the share price of commodity-related firms, and on JPMorgan Chase reporting earnings which beat analysts’ expectations, in turn having a positive impact on the share price of FTSE 100 financial firms.

JPMorgan 1Q adj. EPS was $1.41 vs. the estimated $1.25, while Chinese exports (in CNY terms) rose by 18.7% YoY vs. the estimated 14.9%.

The FTSE 100 Materials Sector gained 5.69%, Financials 4.69%, while the Energy Sector increased by 2.37% on the day.

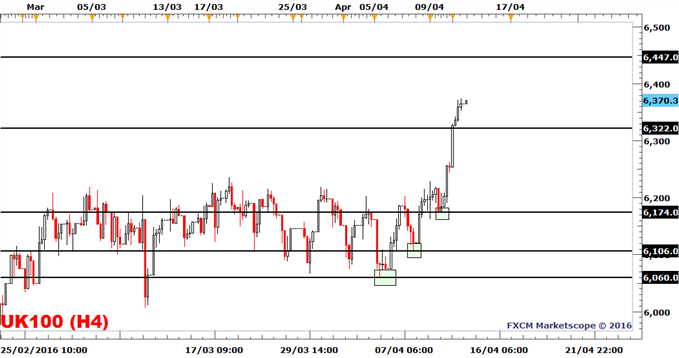

Monday’s low of 6174 is the most recent swing low as seen in the four-hour-chart below and because it’s higher than the prior swing low of 6105, the short-term trend is bullish. We do note that because it’s a short-term low, it will be less strong than a low on the daily chart as the April 5 low of 6060.

With the breach to the December 29 high of 6322, the next resistance ahead of the FTSE 100 is the December 2 high of 6447. A potential short-term resistance level, before the December 2 high, is the physiological level of 6400.

This morning, the market focus will be on the Bank of England Rate Decision. The bank is, per a Bloomberg Survey, expected to leave its key rate unchanged at 0.50% along with the Asset Purchase Target, which is also looking to remain unchanged at 375b. Last month, the bank itself saw no reason to increase rates, citing “subdued” core inflation as a reason and as we approach the E.U. referendum in June, economists see one less reason to expect a change in monetary policy.

In the afternoon, the focus will be on U.S. Initial Jobless Claims and U.S. Consumer Price Index.

Our Stock Market forecasts for Q2 2016 are now live on the site. Download them for free.

FTSE 100 | FXCM: UK100

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00