Talking Points

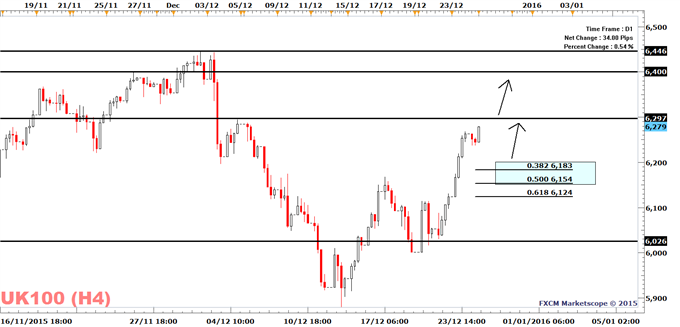

- FTSE 100 remains strong and may about to break the December high at 6297

- S&P/Case-Shiller House-Price Index on Tap

The FTSE maintains its bullish momentum of last week and may head higher in the days ahead on a break to the December 4 high of 6292. In this scenario I see the FTSE 100 reaching the psychological level of 6400. Strong resistance can be found at 6446 which is the December high.

If price is unable to breach the 6292 high of December 4 the FTSE is expected to give back some of last week’s gains. In this scenario the FTSE may reach last week’s breakout level of 6173. But this should not spell the end of the bullish trend, rather I expect traders to use a pullback as an opportunity to buy in the 6200 to 6150 range with the risk-reward ratio being favorable.

Read the Traits of Successful Traders Guide to understand why a good risk-reward ratio is important.

S&P/Case-Shiller House-Price Index on Tap

According to a Bloomberg News survey, house prices are projected to increase by 5.6% YoY in 20 major metropolitan areas of the U.S.A. This would be in line with the developments of the last 12 months.

Leading series like New Home Sales, Permits, Existing Home Sales and the National Associations of Home Builders sentiment index are all keeping their trends of the last few years. With this in mind I expect house prices to remain strong over the next few months.

Overall I see little reason for the short-term FTSE 100 trend end with no major data on tap. Monday next week will be more interesting with U.S. ISM and Markit PMI on tap.

FTSE 100 / UK100

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Learn more about trading and join a London Seminar

To be added to Alejandro’s e-mail distribution list, please fill out this form