Talking Points

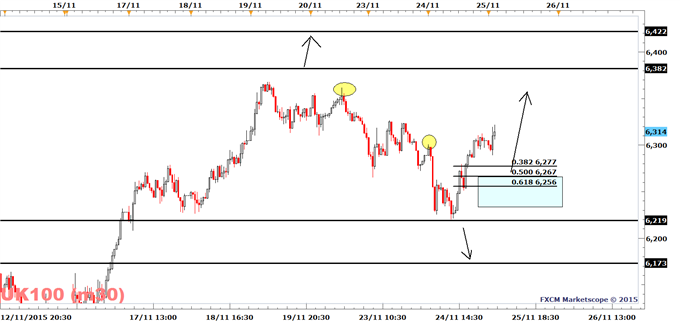

- Yesterday’s panic has settled and the 6219 low is the FTSE 100’s new trend defining level, with traders not long probably seeking an entry on a pullback

- Muted trading today but a raft of U.S. data on tap this afternoon

With no major data until this afternoon and no other major markets in short-term distress e.g. EURUSD, I am expecting equity indices trading to be muted for the first few hours of today.

The FTSE 100 maintains a bullish bias and traders used yesterday’s panic on the downing of the Russian jet to add to their long exposure. A low was created at 6219 and this is the new trend defining level. As long as the FTSE 100 trades above this level we may reach last week’s high of 6369 and beyond, while a break to yesterday’s low of 6219 may trigger a decline to 6173 (61.8% correction of a rally from 6050 to 6382).

Traders looking to enter with the prevailing trend will probably seek long positions in the 6219 to 6268 range (50% correction of the rally from 6219 to 6316).

What are the most common trading mistakes? Get the Traits of Successful Traders Guide

Raft of Data on Tap Due to Thanksgiving

There are many different key indicators on tap this afternoon due to Thanksgiving, as it appears that the remainder of this week’s U.S. data will be published today. As the calendar looks right now we do not have any major U.S. data releases on Thursday and Friday.

For the FTSE 100, I watch U.S. Durable goods orders, U.S. Markit Services PMI and Jobless claims. With the prevailing price being upwards trending I assume that U.S. data needs to be soft to break the trend. In particular I watch the U.S. Markit Services PMI as it has a tendency to set the tone for a few days.

U.S. Personal Consumption Expenditure Core is also on tap, and it’s closely watched by FX markets as it’s the Fed’s preferred inflation gauge. A higher than expected reading will probably lift the Dollar and may hurt the FTSE 100 if the commodity complex gets hit. But for now the short-term crude oil trend is not bearish, and gold is also not doing too badly, hence, the FTSE 100 remains supported.

Suggested Reading: Aussie Dollar Little Changed After China Consumer Sentiment

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Learn more about trading, join a London Seminar

To be added to Alejandro’s e-mail distribution list, please fill out this form