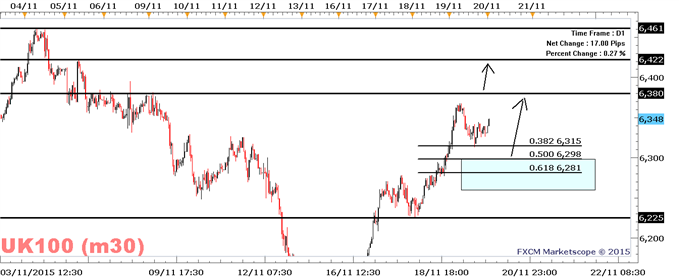

The FTSE 100 remains bullish but may slow down as it gained 5.2 percent from its Monday low. The trend remains bullish above Wednesday’s low of 6225, and price may reach the November 9 high of 6383. In the case 6383 is not able to cap price, then 6422 is the next resistance level lined up.

Given the bullish trend, I expect traders to see a pullback to the 6300-6262 range as an opportunity to add to their long exposure.

See how retail traders are positioning in the majors in your charts using the FXCM SSI snapshot.

ECB and FOMC Minutes Fires Up For The Bulls

The latest leg of the stock market rally was triggered by dovish minutes from two of the world’s most important central banks: the FED and the ECB.

The former still looks to raise rates in December; however, the markets perceived the minutes as dovish saying that the increase in the Fed funds rate will be gradual.

In the case of the ECB, some of its members already called for increased stimulus at the October 22 governing council meeting. Low inflation worries the ECB, and we note that, with Brent crude oil prices remaining low, there is an increased likelihood that a rise in inflation will take time. We also note a slack in the labour market. The current E.U. unemployment rate is 9.7 percent, while the OECD NAIRU unemployment rate is 9.4 percent. When the unemployment rate is above the NAIRU estimate, the inflation rate tends to soften; when the unemployment rate is below the NAIRU estimate, inflation tends to pick up.

The key takeaway from the ECB minutes is that the ECB stands to do much more to support the economy. This is boosting equity markets and keeping E.U. bond rates at ultra-low levels, which gives market participants few options other than going long on equity markets.

As we lack important data releases, today’s trading should be technical in nature.

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Learn more about trading, join a London Seminar

To be added to Alejandro’s e-mail distribution list, please fill out this form