U.S. Indices Technical Outlook:

- S&P 500 recovery anticipated to continue for a bit longer

- Nasdaq 100 has clear levels to watch in the days ahead

- Dow Jones has a prior high it needs to overcome

S&P 500, Nasdaq 100, Dow Jones Technical Outlook Remains Positive

The market has had a strong upward move since last week, and on that the recovery bounce is still intact. It is seen, however, as being a potentially bumpy ride higher as the overall upward trajectory is viewed as countertrend in nature within the context of a bear market move.

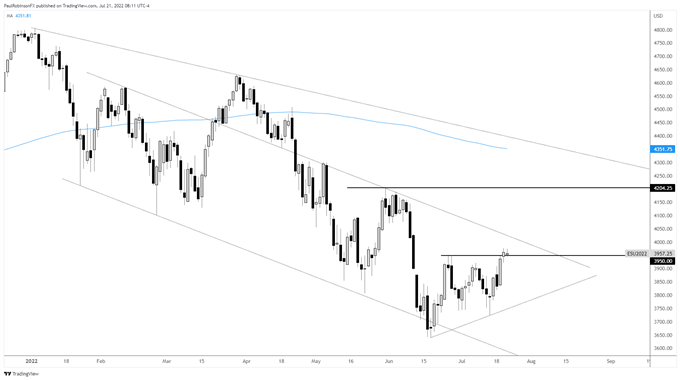

This means strength with overlapping price action as the market is unable to garner any real sponsorship, and thus momentum. The S&P 500 is trying to get over a late-June swing high but struggling at the moment. A set back from here will be watched closely for another higher low since the June bottom.

Just ahead lies a slope from early in the year that could act as resistance. It currently clocks in around the 4010 mark. Should we see slope resistance broken look for more strength up towards 4100, with the 4200 area being the most optimistic target before another meaningful high is put into place.

The thinking is that right now we are seeing a summer recovery before a fall swoon that will take the market much lower. It may be during that swoon a meaningful low is put into place, but until we see capitulation any rally that unfolds prior to such an event will continue to be viewed as only corrective and vulnerable to failure.

S&P 500 Daily Chart

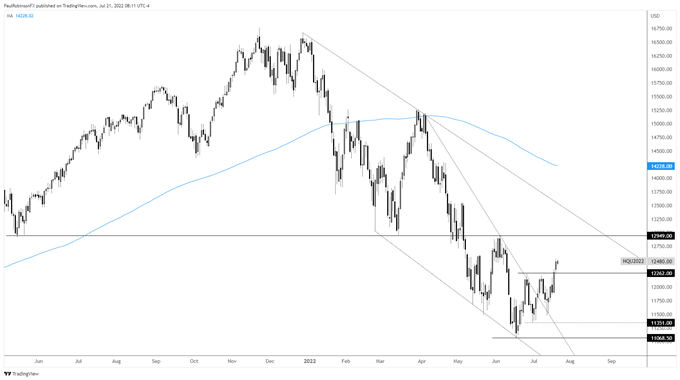

The Nasdaq 100 is showing some leadership and suggests the market still has some gas in the tank. It has made a higher high from the late June swing-high. Minor weakness into the 12262 area will be watched for signs of support. On the top-side, the 12950 area appears to be up next as a target.

Nasdaq 100 Daily Chart

Nasdaq 100 Chart by TradingView

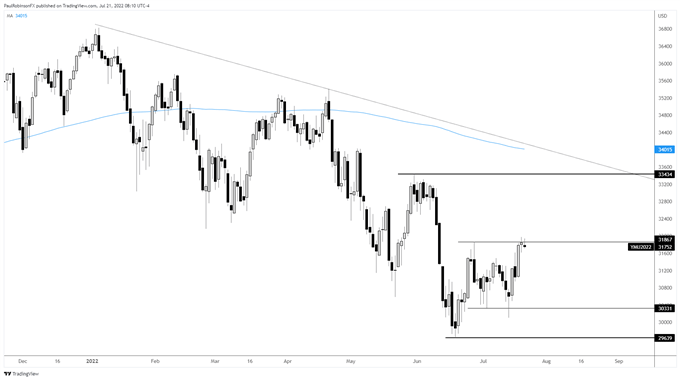

The Dow Jones is currently failing to cross the late June high, and will need to do-so to keep its bounce going. We may see some more struggles around the 31867 area before climbing higher, but it is anticipated that higher levels will come one way or another.

Dow Jones Daily Chart

Dow Jones Chart by TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX