S&P 500/Dow Jones/Nasdaq 100 Outlook:

- S&P 500 pulling back from record levels

- Dow Jones could consolidate before trading higher

- Nasdaq 100 showing relative weakness

- Bonus chart: Keep watching the Russell

See how the quarterly forecast has played out what it could mean for the big-picture – Q2 Equity Markets Forecast.

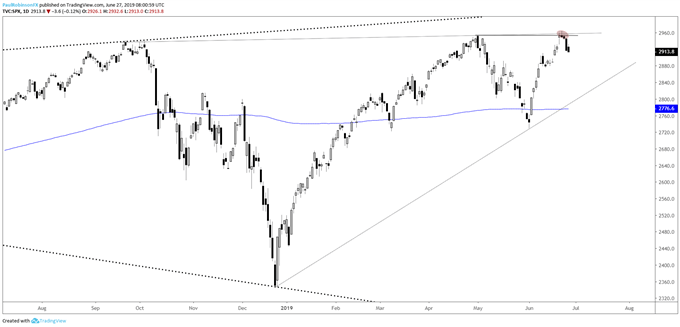

S&P 500 pulling back from record levels

The S&P 500 is reacting a bit from around record levels as was suggested might happen last week, and while the initial move lower has held a little bit of power we can’t yet read too much into it from a bearish standpoint.

Seeing a snapback here and bit of consolidation may gear the market up for a move higher soon. The tone and trend are still favorable at the moment. What could change this, however, is if the S&P 500 turns back up towards the high at 2964 and posts a clear failure, resulting in a lower-high or double-top. A turn up and swift rejection a second time may do the trick for giving sellers the upper hand.

But conviction is lacking and which way the market wants to resolve itself is still very much up air at the moment; need to give the market a minute to breathe and provide better indications before running with a strong trading bias in either direction.

Check out the IG Client Sentiment page to see how retail traders are positioned and what it could potentially mean for various currencies and markets moving forward.

S&P 500 Daily Chart (watch how another turn higher unfolds)

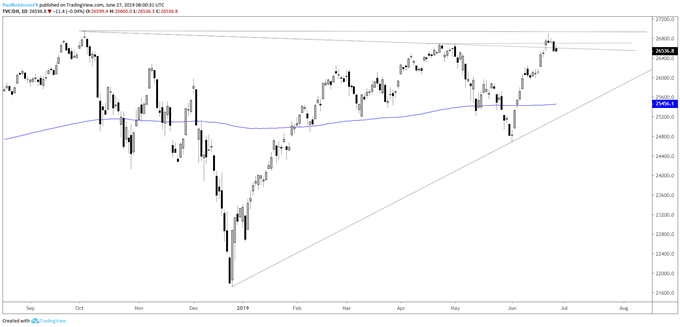

Dow Jones could consolidate before trading higher

The Dow Jones is turning down from around record levels, but holding up a little bit better than the other indices. A period of consolidation would do the index some good before trying to launch through the 26952 level.

Dow Jones Daily Chart (consolidate before push to highs?)

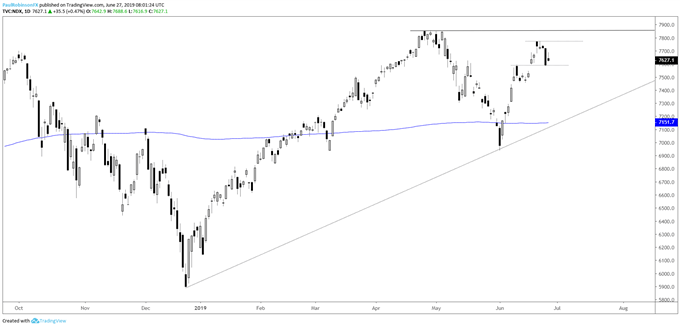

Nasdaq 100 showing relative weakness

The down-move met support from June 11 at 7595, a good spot to see the Nasdaq 100 turn higher from. Overall there is still some lag as it has yet to trade to the record high levels from April. If it is to do so a move through 7770 will need to develop, first, then the 7852 can be challenged.

Nasdaq 100 Daily Chart (levels to watch)

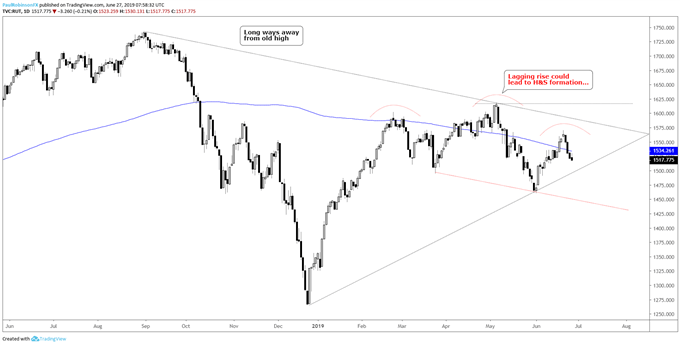

Bonus chart: Russel 2k lag is concerning

Continue to monitor the Russell 2k, a barometer of overall market health I continue to focus on as it lags severely on all time-frames from short to long-term. Keep an eye on the head-and-shoulders (H&S) pattern that is developing. A crossing below the trend-line of the December will quickly have he neckline in focus and potential break. If this pattern triggers it would be a bad omen for the market.

Russell 2000 Daily Chart (H&S forming...)

To learn more about U.S. indices, check out “The Difference between Dow, Nasdaq, and S&P 500: Major Facts & Opportunities.” You can join me every Wednesday at 10 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX