S&P 500/Dow Jones/VIX Outlook:

- S&P 500 below 200-day, near bottom of rising wedge

- Dow Jones near earlier-year gap-fill, below support

- VIX yet to spike, more weakness might cause an ‘event’

See how the quarterly forecast has played out so far and what it could mean to end June in the Q2 Equity Markets Forecast.

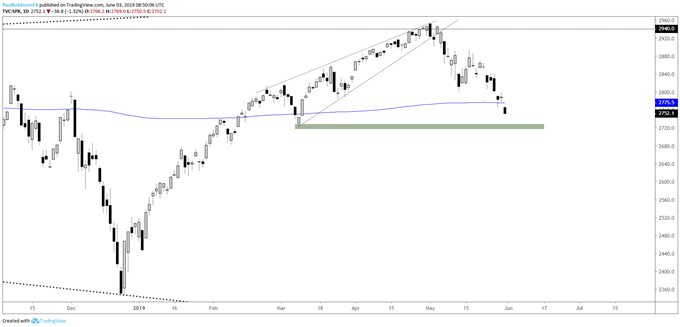

S&P 500 below 200-day, near bottom of rising wedge

The S&P 500 dropped below the 200-day MA on Friday, now moving towards the bottom of the rising wedge pattern that kicked off the recent bout of weakness. The bottom of these patterns is viewed as the first significant target and may help induce a bounce.

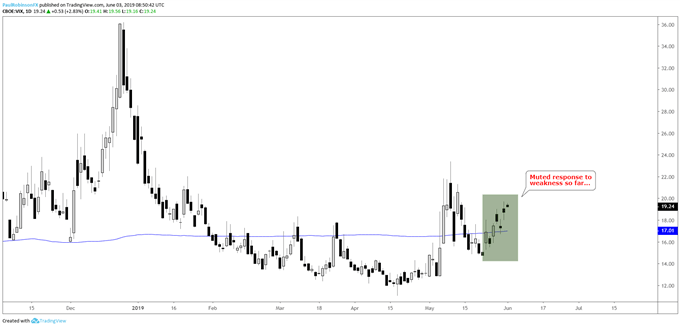

So far, the manner in which the market is weakening isn’t very concerning, though, at least not to options traders who don’t seem to be too worried as the Cboe Volatility Index (VIX) is showing a muted response. Often the VIX is regarded as a ‘fear barometer’ for its tendency to rise during declines and fall during rallies.

With an acceleration lower in stocks a sharp rise in the VIX is almost certainly to develop. Watch for signs of it suddenly surging in the days ahead with more selling in the S&P 500. A sudden spike would indicate a wash-out and a likely low for the market in the near-term.

This would be viewed as a bigger picture positive for stocks as minor down-moves quickly met with high levels of fear are seen as a healthier development than if the market were to continue to slide without seeing some type of ‘panicky’ behavior.

We may soon see a bounce without getting a VIX event, but overall market participants seem relatively complacent in the face of weakness and this may be signaling that a broader decline, whether from here or following a small bounce, could become much more severe in the not-too-distant future.

Check out the IG Client Sentiment page to see how retail traders are positioned and what it could potentially mean for various currencies and markets moving forward.

S&P 500 Daily Chart (nearing bottom of wedge)

VIX Daily Chart (not very jumpy)

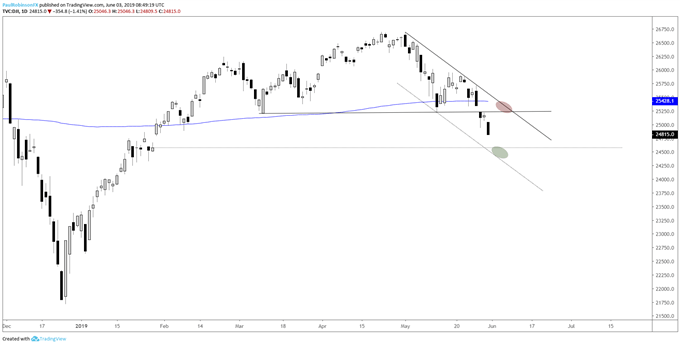

Dow Jones near earlier-year gap-fill, below support

The Dow Jones broke the swing lows created in March and last month just above 25200, now heading towards a gap-fill in January at 24580. It’s not a major level of support, but with a lower parallel in the same vicinity and the S&P 500 nearing the bottom of the rising wedge pattern we may see the Dow bounce soon.

Old support becomes new resistance on a bounce, with the 25200-area up to the 200-day MA at 25428 and trend-line off last month’s high acting as roadblocks for further strength.

Dow Jones Daily Chart (Held 200-day, gap to fill)

To learn more about U.S. indices, check out “The Difference between Dow, Nasdaq, and S&P 500: Major Facts & Opportunities.” You can join me every Wednesday at 10 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX