What’s inside:

- The S&P 500 is working off oversold conditions

- The Nasdaq leading the way or market divergence sign of more weakness to come?

- Short-term chart and levels in focus

On Friday, we discussed the S&P 500 bounce from deeply short-term oversold, but we asked whether it was for real. Has the market found a tradable low and ready to push to new heights or is it working off oversold conditions before taking another stab lower?

The Nasdaq 100 recovered very quickly back to near record highs after falling for what amounted to a one-day bear market, which shows us there are plenty of dip buyers out there. Apple (AAPL) shares flexed their muscles during the bounce (trading from 102s to 115s in days), which with the Nasdaq being dominated at the top by a few names helps explain why the tech-heavy index has been so much stronger than other major US indices.

The S&P and Dow continue to lag behind and aren’t nearly as buoyant. The takeaway from this is unclear. The Nasdaq could be leading the way and soon the others will follow suit, or we could simply be witnessing a divergent market that could lead to further weakness.

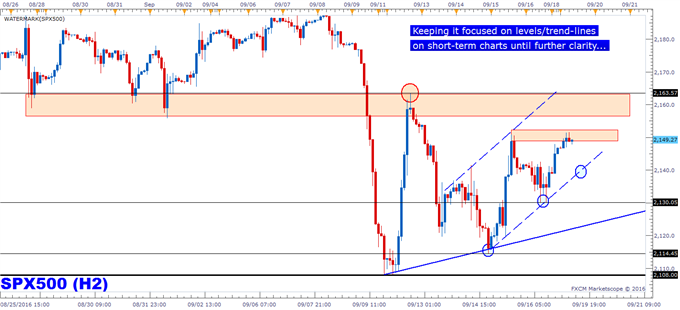

We have our attention focused on the S&P intra-day charts in our search for clarity, and given the lack thereof on the daily, our trading continues to be centered around ‘hit-and-run’ opportunities.

In early trade today the S&P is finding some resistance around the 9/15 pivot at ~2151. A break above 2151 will lead to the market quickly into resistance in the 2155/63 zone. As long as the market stays below 2163, then a lower high could develop more broadly from the highs in the early month, keeping the chart pointed more bear than bull.

Support arrives at a small trend-line/lower parallel running back to 9/14 (this may keep the very near-term pointed higher, making it pivotal for now), then below there the Friday low of 2130, the trend-line off the recent swing low to start last week, 2114, then 2108.

Follow trader sentiment in real-time via the SSI indicator.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinonFX.

If you would like to receive articles directly into your inbox, sign up here.