What’s inside:

- Yellen sparks volatility on Friday

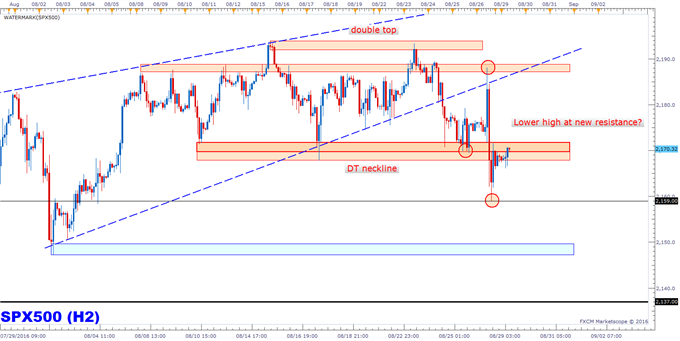

- Double-top leads to support break

- Will use old support as new resistance, other levels outlined

On Friday, the S&P 500 experienced outsized volatility as a result of Yellen’s speech at the Jackson Hole Symposium. The nearly 30 handle range for the day was the largest since the second trading day of the month.

The net result wasn’t significant as the market closed only a few handles away from where it began the day, but the price action in between certainly wasn’t boring, as it gave day-traders a crack at a few good fade-trades.

It was a welcomed spat of volatility, but don’t be surprised if that is all it was for now. The unofficial end to the summer season comes after the Labor Day holiday (next Monday). Heading up to and even the week of, trading volumes and volatility often times remain light without any major catalysts.

Friday, the monthly jobs report for August will be released, presenting another possible pocket of volatility, but until we move on past the summer doldrums we remain content in keeping our trading size low and trade selectivity high.

The double-top formation we have been discussing in recent commentary further developed on a break below the 2168/72 area. As said last week, given the current choppy market conditions, the preferred scenario was to see the S&P drop below the neckline and then retest before looking for another drop lower.

Support was indeed broken on Friday (support now turns into resistance) and as of this morning the market is trading back in the thick of it. As long as there is no sustained trade above 2172, we will look for the market to struggle to gain further traction and favor sellers. On a move lower, support comes in at Friday’s low at 2159, then the 8/2 low of 2147.

If the S&P moves back above the 2168/2172 support zone, we may be in for more two-way sloppy trade.

The summer lull presents a good time to sharpen your skills before markets pick back up again. Get started today by checking out one of our free trading guides.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX.

You can email him at instructor@dailyfx.com with any questions or comments.