New Zealand Dollar Rates Overview:

- The New Zealand Dollar is well-positioned for more gains, similar to its Australian Dollar brethren; like AUD/JPY and AUD/USD rates, NZD/USD rates are in bullish breakout territory.

- The New Zealand Dollar, a growth-linked currency, has benefited from rising risk appetite as the Asia-Pacific region has weathered the pandemic better than the West, and moreover, coronavirus vaccine approval and deployment has begun across developed Western economies.

- The New Zealand Dollar has a bullish bias, according to the IG Client Sentiment Index.

New Zealand Dollar Gains Build

Among all of the countries tied to the major currencies, its hard to argue that any country has fared better during the coronavirus pandemic than New Zealand. The New Zealand Dollar, a growth-linked currency, has benefited from rising risk appetite as the Asia-Pacific region on the whole has weathered the pandemic better than the West, and moreover, coronavirus vaccine approval and deployment has begun across developed Western economies.

More liquidity in financial markets, thanks to the December ECB rate decision, is helping spur a global reach for growth-linked currencies and assets once more. In this environment of broadening optimism, the New Zealand Dollar is well-positioned for more gains, similar to its Australian Dollar brethren; like AUD/JPY and AUD/USD rates, NZD/USD rates are in bullish breakout territory.

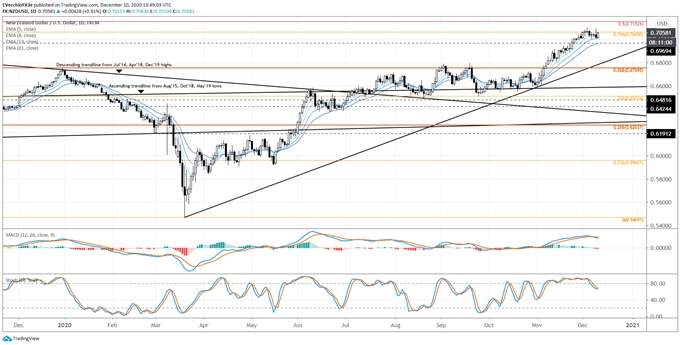

NZD/USD RATE TECHNICAL ANALYSIS: DAILY CHART (December2019 to December 2020) (CHART 1)

A bearish daily hammer candle on Wednesday has been met by a bullish inside day thus far on Thursday, with NZD/USD rates holding near session highs at the time of writing. NZD/USD rates rebounded off of the daily 13-EMA, which the market has held above every session since November 2. The sideways churn seen since the start of December may be coming to an end; a breach of the December high at .7104 would signal the start of the next leg lower.

Bullish momentum is returning, with NZD/USD rates back above the daily 5-, 8-, 13-, and 21-EMA, which is still in bullish sequential order. Daily MACD’s drop in bullish territory is being curtailed, while Slow Stochastics have already started trending higher once more while above their median line. Coupled with the backdrop of a strong monthly seasonality trend, NZD/USD rates retain an upside bias.

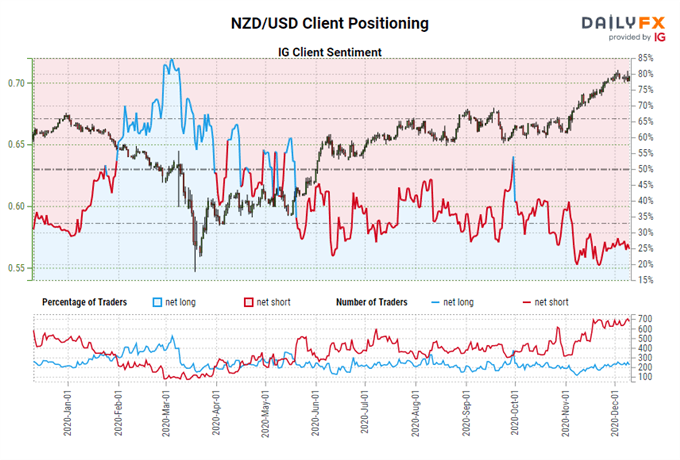

IG Client Sentiment Index: NZD/USD RATE Forecast (December 10, 2020) (Chart 2)

NZD/USD: Retail trader data shows 26.15% of traders are net-long with the ratio of traders short to long at 2.82 to 1. The number of traders net-long is 4.02% lower than yesterday and 8.08% lower from last week, while the number of traders net-short is 6.30% higher than yesterday and 2.27% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bullish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist