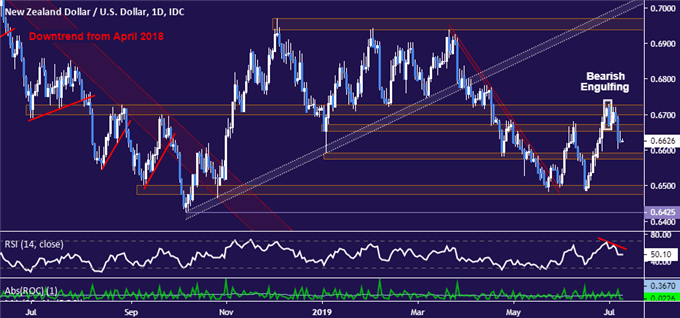

NZDUSD Technical ANALYSIS: NEUTRAL

- New Zealand Dollar marks swing top with Bearish Engulfing pattern

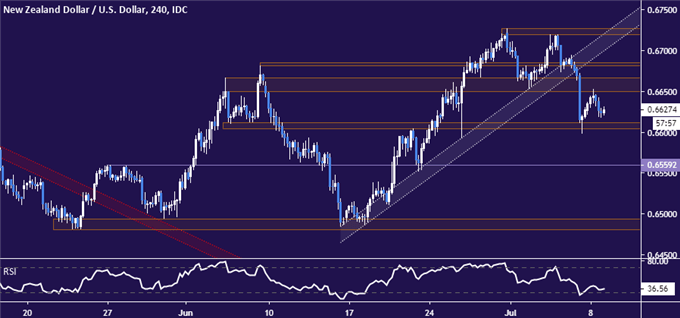

- Break of uptrend from mid-June lows points to near-term bias change

- Risk/reward improvement probably needed to inspire follow-through

See our free trading guide to help build confidence in your NZDUSD trading strategy !

The New Zealand Dollar turned lower against its US counterpart after producing a Bearish Engulfing candlestick pattern, as expected. Sellers now target support in the 0.6575-91 area, with a break below that confirmed on a daily closing basis exposing the 0.6476-0.6501 zone. Resistance begins at 0.6653 runs upward through a dense bloc of overlapping barriers through 0.6727.

Zooming in to the four-chart reveals a critical big of evidence supporting the case for downside follow-through. Prices have broken well-defined support guiding NZDUSD higher since mid-June, pointing to a palpable change in the prevailing near-term trend and adding a sense of bearish immediacy. Rejection at former support above 0.66 following the breakdown hints at further reinforcement.

With this in mind, prices are sitting in close proximity to immediate support, which might undercut the risk/reward case for establishing new short exposure. This might mean that the next sizable leg lower will require either a pull-up to improve relative positioning or further breakdown. The fundamental landscape seems to set the stage for the latter as markets ponder key event risk shaping Fed policy bets.

NZDUSD TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the Comments section below or @IlyaSpivak on Twitter