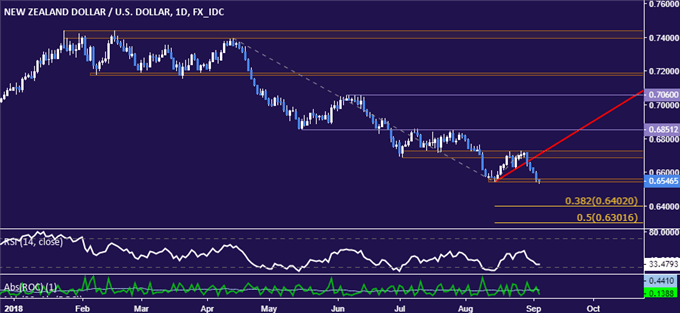

NZD/USD Technical Strategy: SHORT AT 0.6680

- New Zealand Dollar back to test August lows after 4-day selloff

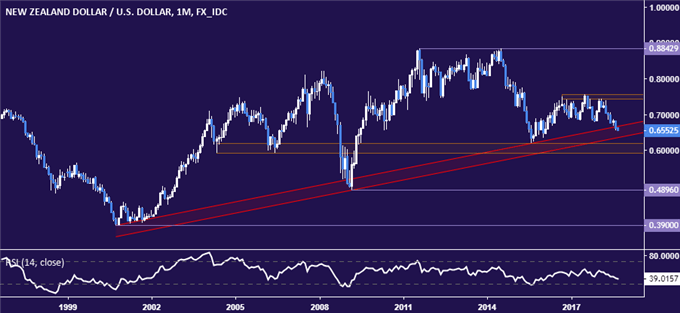

- Monthly chart reveals 18-year rising trend vulnerable to reversal

- Holding short amid search for resolution at key inflection point

See our free trading guide to help build confidence in your NZD/USD trading strategy !

Four consecutive days of losses have brought the New Zealand Dollar down for another test of Augusts’ swing bottom against after the currency resumed the downtrend against its US counterpart, as expected.

A daily close below the 0.6545-60 area opens the door for a challenge of the 38.2% Fibonacci expansion at 0.6402. Alternatively, a reversal above support-turned-resistance in the 0.6688-0.6726 zone paves the way for a retest of the May 16 low at 0.6851.

The sense that prices are at a key inflection point is reinforced in longer-term positioning. The monthly chart reveals prices are starting to work their way through support that has guided the uptrend for nearly two decades. A break below this juncture may open the door for a substantially more pronounced decline over the coming months and years.

The short NZD/USD trade triggered at 0.6680 has now met its initial objective at 0.6560. Adding to exposure is unattractive from a risk/reward perspective as the pair tests chart support. On the other hand, booking out of the trade seems premature before a clearer resolution of the directional bias at this critical juncture. With that in mind, a wait-and-see approach appears to be most prudent.

NZD/USD TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the Comments section below or @IlyaSpivak on Twitter