To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

- New Zealand Dollar rises to one-year high after RBNZ rate decision

- Tactical and risk/reward considerations argue against taking a trade

The New Zealand Dollar continued to surge against its US counterpart, taking out April’s swing high and hitting the highest level in a year. The rally found fresh fodder in the RBNZ monetary policy announcement as the central bank signaled it is in no hurry to resume interest rate cuts.

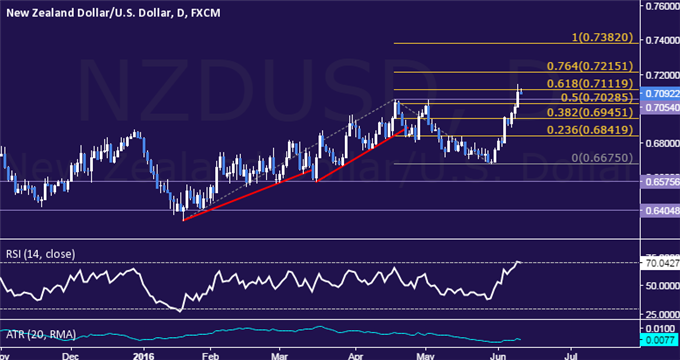

From here, a daily close above the 61.8% Fibonacci expansion at 0.7112 opens the door for a test of the 76.4% level at 0.7215. Alternatively, a reversal below the 50% Fib at 0.7089 paves the way for a challenge of the 38.2% expansion at 0.6945.

On one hand, prices are too close to near-term resistance to justify entering long from a risk/reward perspective. On the other, the absence of a clear-cut bearish reversal signal suggests it is premature to take up the short side. With that in mind, staying flat seems most attractive for the time being.

Losing money trading NZD/USD? This might be why.