To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

- Kiwi Dollar attempting to recover after finding support below 0.68 figure

- Rising Wedge setup argues for bearish reversal but confirmation absent

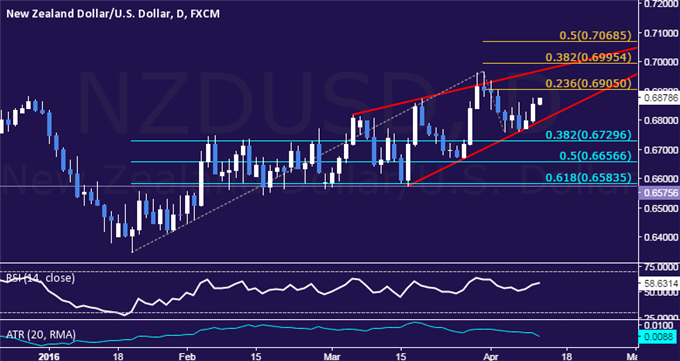

The New Zealand Dollar is attempting to rebuild upside momentum against its US namesake having found support below the 0.68 figure. Prices remain confined within the boundaries of a Rising Wedge chart pattern however, a setup frequently indicative of on-coming bearish reversal.

From here, a daily close above the 23.6% Fibonacci expansion at 0.6905 paves the way for a test of the 0.6969-95 area, marked by the wedge top and the 38.2% level. Alternatively, a push through the range floor at 0.6797 opens the door for a challenge of the 38.2% Fib retracement at 0.6730.

We maintain a broadly bearish bias on NZD/USD, in line with our 2016 fundamental forecast. While the wedge setup seems to agree with this assessment, an actionable trigger to enter short is absent for the time being. With that in mind, we will remain on the sidelines until a more compelling opportunity emerges.

Are you making this common mistake trading NZD/USD? Find out here !