To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

- New Zealand Dollar Returns to the Offensive vs. USD Following RBNZ Rate Decision

- Waiting for Actionable Short Trade Signal to Sell in Line with Dominant Down Trend

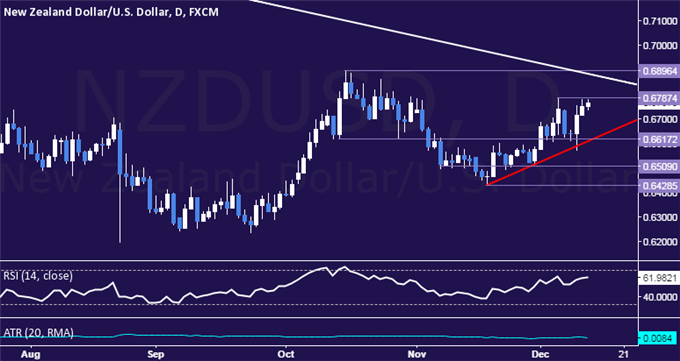

The New Zealand Dollar is attempting to renew the recovery against its US namesake having found support following the RBNZ monetary policy announcement. Prices established a near-term bottom above the 0.64 figure and launched upward as expected after carving out a bullish Head and Shoulders chart pattern.

A daily close above the December 4 high at 0.6787 opens the door for a challenge of 0.6896, a level marked by the October 15 top and a falling trend line set from July 2014. Alternatively, a reversal below the intersection of near-term rising trend line support and a horizontal pivot at 0.6617 paves the way for a test of another recently significant inflection point at 0.6509.

The dominant long-term NZD/USD trend continues to favor the downside, suggesting the current upswing represents a correction to be sold into. An actionable signal pointing to imminent bearish reversal is conspicuously absent however. With that in mind, we will remain flat and await confirmation of topping ot enter short.

Losing Money Trading Forex? This Might Be Why.