To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

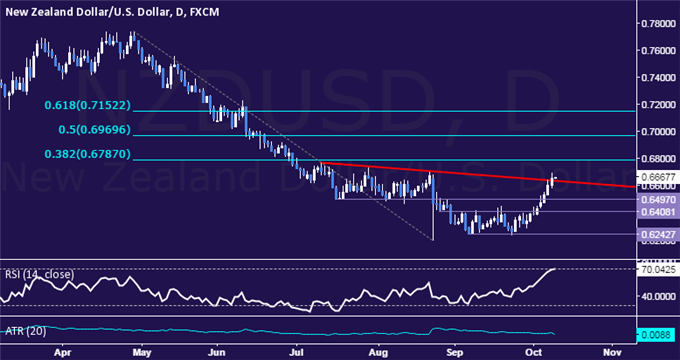

- Prices Aim Higher After Break of Three-Month Trend Line Resistance

- Upswing Seen as Corrective, Waiting for Entry Signal to Trigger Short

The New Zealand Dollar is en route toward securing its longest win streak in 17 months against its US counterpart as prices work on a sixth consecutive advance. A recent flip to net-short on our SSI positioning indicator bolsters the case for an upside scenario.

From here, a daily close above the 38.2% Fibonacci retracement at 0.6787 opens the door for a test of the 50% level at 0.6970. Alternatively, a turn back below trend line resistance-turned-support, now at 0.6633, sees the next downside inflection point marked by a horizontal support shelf (and former range floor) at 0.6497.

On balance, the overall trend continues to favor the downside, painting the latest upswing as corrective. With that in mind, we will continue to stand side for now and wait for prices to deliver an actionable sell signal after the move higher is exhausted.

Losing Money Trading Forex? This is Probably Why!