Talking Points:

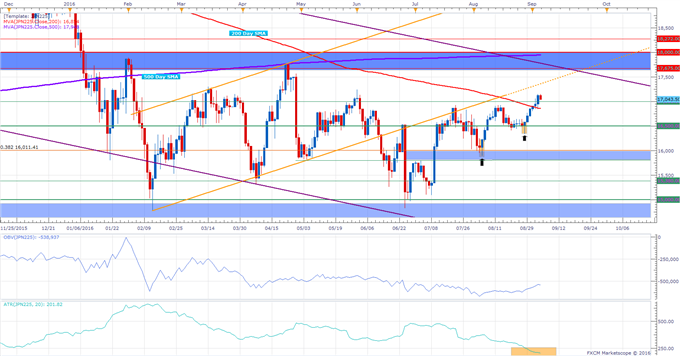

- Index breaks above key resistance at 17,000

- The Nikkei might need to hold the level as support for further upside gains

- Zone below 18,000 appears to be the main hurdle for bulls

If you’re looking for trading ideas, check out our Trading Guides Here

The Nikkei 225 is nudging lower, alongside a slight pickup in Yen prices, after the index broke above the 17,000 level.

The 17,000 handle signaled a confluence resistance zone with the round number, 200-day SMA and the last swing highs, which might imply that the Nikkei might need to hold above those levels as support for further upside gains.

The price has been ranging between the well-defined 18,000 resistance zone and the 15,000 support since the start of the year, with gains appearing to be corrective in the context of the near term down trend from June 2015 highs.

In this context, a hold above 17,000 could potentially expose the longer term range top levels below 18,000.

If the index fails to hold above and moves lower, focus might shift to 16,500 for support followed by the 16,000 level.

Volatility continues to become even more subdued, with 20-day ATR volatility measures now indicating the lowest levels since late 2014.

Nikkei 225 Daily Chart: September 5, 2016

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com

Follow him on Twitter at @OdedShimoni