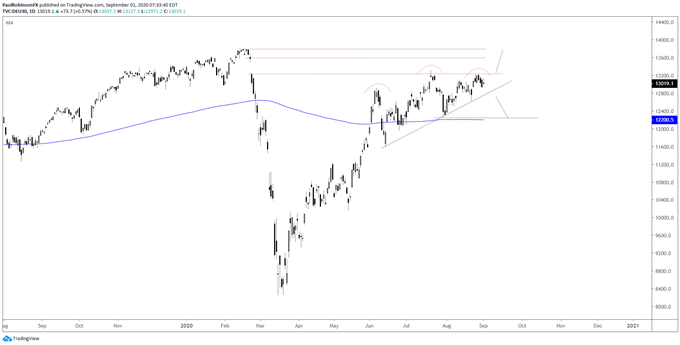

DAX 30 / CAC 40 Technical Highlights

- DAX 30 stalling under corona-gap, working towards pattern resolution

- CAC 40 wedge continues to develop with relative weakness prominent

DAX 30 continues to look vulnerable

The DAX continues to struggle with closing the corona-gap, a gap that seems all but inevitable to fill – but is it? Perhaps not, not all gaps must fill. The area around 13200/300 will remain a focal point of resistance. Price action is narrowing and the head-and-shoulders pattern looked at last week is still on the cards.

It isn’t the cleanest or most technically sound pattern, but sometimes these turn out to be the best. Whether you agree it’s a solid pattern doesn’t really matter, there are good levels to watch for a trading bias. The lag behind the S&P 500 is glaring and suggests from a relative strength standpoint that if the leading U.S. markets roll over, European indices (& FTSE) are likely to be in trouble.

The neckline of the would-be H&S formation needs to break, first, and if it does this could quickly push the index to an important test of the flat-lining 200-day MA just below the July 30 low at 12253. A break below 12200 is seen as having the DAX trading off aggressively, and at that point the S&P 500 is probably on its backfoot as well.

To negate an increasingly bearish bias, the DAX needs to cross 13313 and fill the corona-gap up to 13579. From there a new record high is probable beyond 13795.

DAX Daily Chart (corona-gap ceiling, H&S potential)

CAC 40 wedge continues to develop

The CAC is weaker than the DAX by a wide margin both in the short and longer-run. The price action since topping in June has been taking on the shape of a large wedge. It could break either way, but given the glaring relative weakness the French benchmark is displaying, it appears likely we will see a downside break. For now the wedge is keeping price action tied up, but a break below 4691 should have momentum in favor of a sell-off, while a break above 5213 is needed to clear above all notable resistance and spark a bullish bias.

CAC 40 Daily Chart (stuck in wedge, support/resistance to watch)

Forex Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX