DAX 30 / CAC 40 Technical Highlights

- DAX 30 poised to fill ‘corona-gap’, test record high

- CAC 40 remains weaker but looking higher

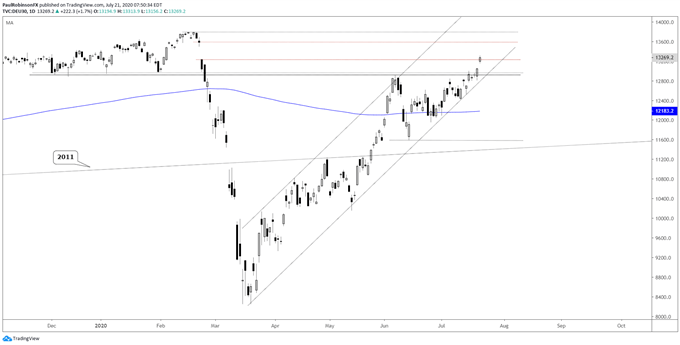

DAX 30 poised to fill ‘corona-gap’, test record high

Yesterday, the DAX crossed resistance extending back to early December, and with it positioning itself to fill the massive gap down that occurred on February 24. The gap runs from 13231 up to 13579 where it would constitute a full gap-fill. It would only take a quick run from there to the record high at 13795.

Given the general risk trends not only in Europe, but perhaps more importantly in the U.S. where the Nasdaq 100 is reaching for the skies, it appears likely both the above thresholds will be met relatively soon, if not exceeded. If this is the case then traders will likely be best served looking for short-term dips and/or consolidation patterns to take advantage of.

It will take a swift turn lower to turn the outlook negative. Keep an eye on the underside channel line extending higher from the March panic lows. It will be the first guide to watch as support, but even if it is broken it won’t necessarily mean the market tanks. This is why watching the quality of price action can be quite helpful.

DAX Daily Chart (corona-gap, record highs in sight)

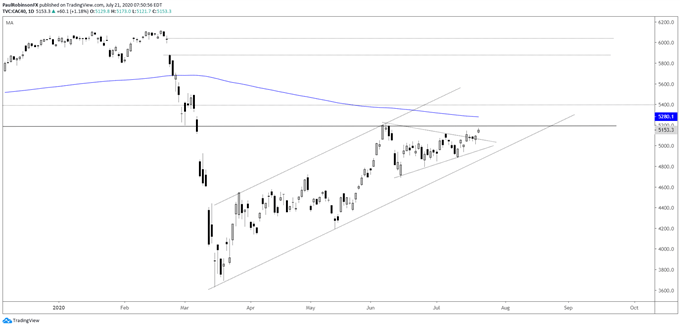

CAC 40 remains weaker but looking higher

The CAC is still fighting to trade to the June highs, and so it is likely that the French benchmark will continue to lag behind the DAX. But as long as broader market forces are a tailwind then it is not likely to keep the CAC from heading higher too. The June high at 5213 arrives around a pair of lows created in 2019. A breakout beyond there will quickly have the 200-day at 5281 in play followed by a pivot from October at 5393.

CAC 40 Daily Chart (test of 200-day may be near)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX