DAX 30/CAC 40 Technical Highlights

- DAX not too far from the record high set in January 2018

- CAC looking to come full circle from before the GFC

For fundamental and technical forecasts, trade ideas, and educational guides, check out the DailyFX Trading Guides page.

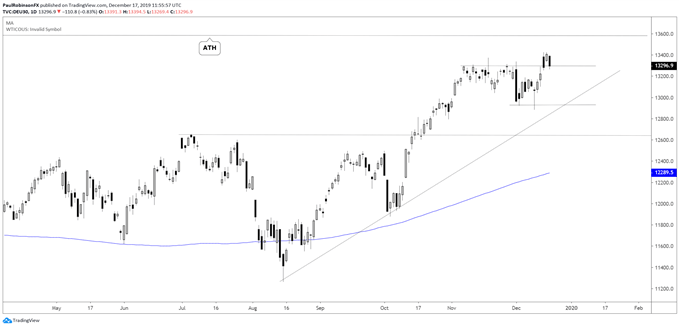

DAX not too far from the record high set in January 2018

Last week the DAX broke above stiff resistance formed during almost the entire month of November into this month, giving it a shot at continuing the tend higher since August. Right now, the market is resting after its recent surge, but new all-time highs could be near.

Staying above the former area of resistance around the 13300-mark is ideal but not completely necessary. A small period of congestion on the top of the prior range would help validate overall strength. A little rest here would likely be enough to add fuel for a move to beyond the 13597-record high.

A sinking back down below 13000 wouldn’t undermine a bullish outlook unless it was done-so with a lot of momentum, and even then, the trend-line from August could help keep the market pointed higher. For now, through year-end into January there is a seasonal tailwind that will help support higher prices.

Betting against the market at this juncture doesn’t hold great appeal from a risk/reward perspective.

DAX 30 Daily Chart (ATH near 13600)

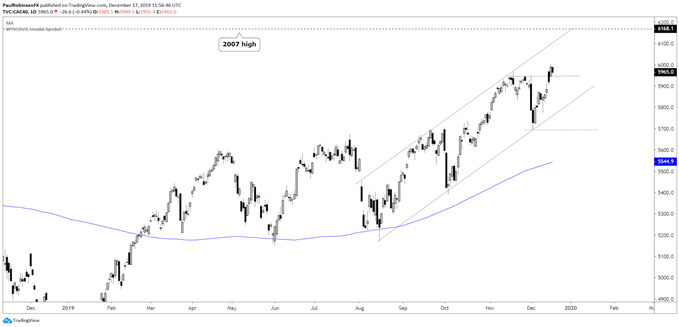

CAC looking to come full circle from before the GFC

The CAC continues to trade higher in an orderly fashion, with the channel dating back to the August low clear. As long as price stays inside the channel then the trend remains pointed higher. This could structure gives the French benchmark a shot at trading to the 2007 high at 6168, the peak before the GFC.

It would be an important milestone for the market even if it isn’t a record high. To reach for a new record the CAC would still need to rally to 6944, still maintained as the ATH since 2000.

CAC 40 Daily Chart (inside channel keeps outlook bullish)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX