DAX & FTSE 100 Technical Highlights:

- DAX rests after impressive run, but could it turn into a reversal?

- FTSE looking to try and trade to best levels since the summer

For our analysts intermediate-term fundamental and technical view on the FTSE and other major indices, check out the Q4 Global Equity Markets Forecast.

DAX rests after impressive run, but could it turn into a reversal?

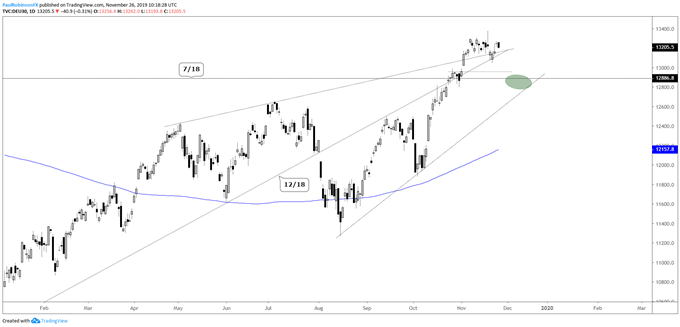

The DAX posted a wicked reversal last Tuesday, and if it were to have the bearish potential those types of candlesticks can have the market would have likely already be much lower. But after a couple of soft follow-through days the DAX has bounced back to keep it moving sideways.

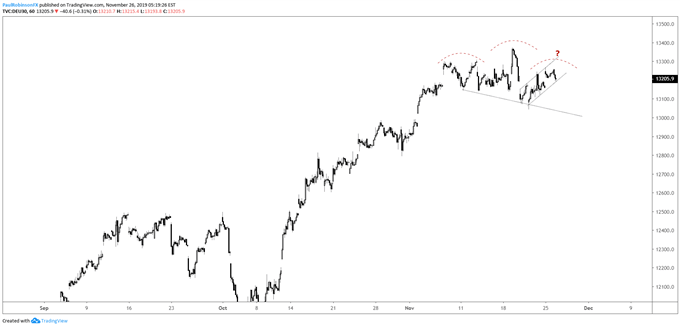

This doesn’t entirely get it out of the woods yet, as there is still potential a topping sequence is getting carved out. But the topping sequence in the form of a head-and-shoulders (H&S) pattern could continue to unfold horizontally and become a continuation pattern.

The state of the market currently in limbo means a little more information will be needed. To trigger an H&S formation the DAX will need to roll down below 13043, the low from last week. Weakness will have attention turned to the 12960/800 area.

Should price stay above support, then it is likely at some point the congestion phase will turn into a top-side breakout. The record high just shy of 13600 will be targeted in the event another leg higher unfolds.

Check out this guide for 4 ideas on how to Build Confidence in Trading.

DAX Daily Chart (holding steady for now, but could change)

DAX Hourly Chart (H&S formation could be in the works, but unconfirmed yet)

FTSE looking to try and trade to best levels since the summer

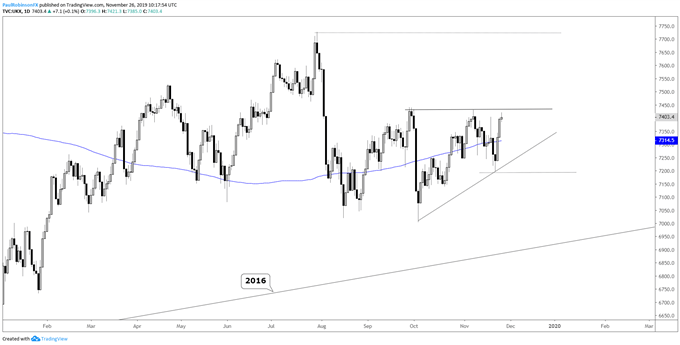

The FTSE had been one of the weaker global indices recently, and on a relative basis since summer it is still is. While other major markets are at yearly highs or better the FTSE still sits well below its July high of 7727.

In its immediate future, the FTSE has a solid area of resistance from around 7k (current prices) up to 7440. The way the FTSE has been bouncing around it may take a good amount of force to get it through to the best levels since summer.

A turn down from resistance, with the trend-line rising up from the October low, will further along the development of an ascending wedge. This scenario would make for some more choppy conditions, even worsening as the apex neared, but make for a potentially clean momentum breakout later.

FTSE Daily Chart (trading around resistance, top of possible wedge)

UK 100 Index Chart by Tradingview

You can join me every Wednesday at 1030 GMT for live analysis on equity indices and commodities, and for the remaining roster of live events, check out the webinar calendar.

Tools for Forex & CFD Traders

Whether you are a beginning or experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX