Dax 30, Dow Jones Outlook

Have you seen our newest trading guides for USD, EUR and Gold ? Download for free our latest forecasts

Dow Jones & DAX 30 – Changing Course

On Sep 12, the Dow Jones peaked at 27,315 since then the index has been creating lower highs with lower lows. Today, the price broke below Sep 3 low printing its lowest in Five weeks at 25,736. Similarly, the Dax fell to its lowest level in nearly five weeks at 11,821.

Alongside this, the Relative Strength Index (RSI) at the start of the month crossed below 50 on both indices highlighting the end of the uptrend momentum and the start of a down trend move.

Just getting started? See our Beginners’ Guide for FX traders

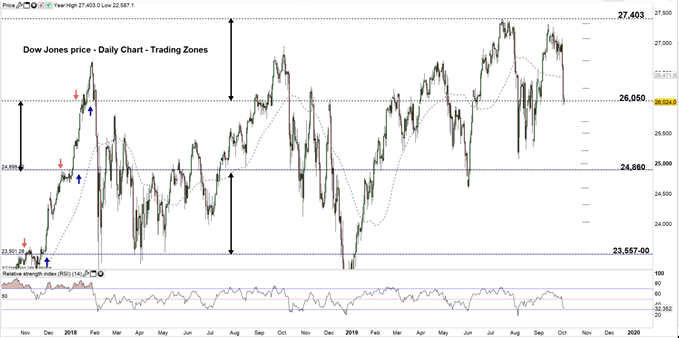

Dow Jones PRICE Daily CHART (Oct 3, 2017 – Oct 3, 2019) Zoomed OUT

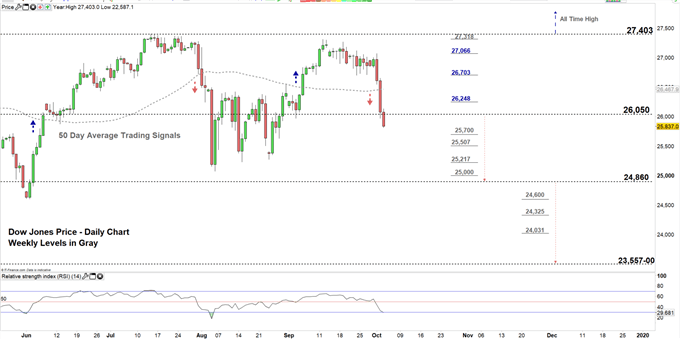

Dow Jones PRICE Daily CHART (April 20 –Oct 3, 2019) Zoomed IN

Looking at the daily chart, we notice yesterday the Dow broke below 50-day average then tested a low end of the trading zone 26,050 – 27,403. However, the price closed above it.

Today, the low end of the zone has been again put to the test. Thus, a close below this level could send the price towards 24,860. In that scenario, the support levels marked on the chart (zoomed in) would be worth monitoring.

On the other hand, another failure at closing below the low end could change the price’s course, sending it towards the high end of the zone contingent on clearing the daily resistance levels underlined on the chart.

Having trouble with your trading strategy? Here’s the #1 Mistake That Traders Make

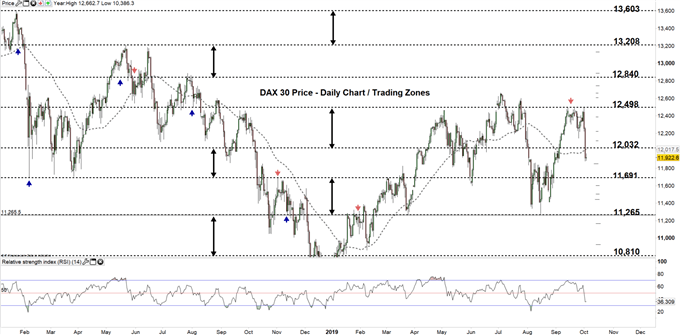

Dax 30 Daily price CHART (Jan 10, 2018 – Oct 3, 2019) Zoomed out

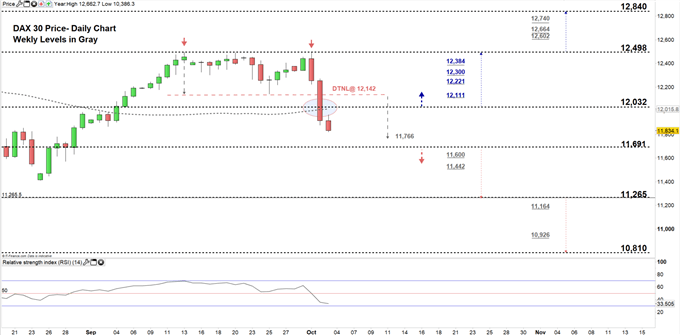

Dax 30 Daily price CHART (July 31 –Oct 3, 2019) Zoomed In

Looking at the daily chart, we notice yesterday the Dax broke below the neckline of double top pattern residing at 12,142. Additionally, the index declined to a lower trading zone 11,691- 12,032 eyeing a test of the low end of it.

This suggests that the price may be on its way towards 11,766, as long stays below the neckline. Its worth mentioning that any close below the low end of the aforementioned trading zone could press the index towards 11,265. Although, the weekly support levels underscored on the chart (zoomed in) should be watched closely.

That said, any failure in closing below the low end could reverse the current direction towards the high end of the zone. Further close above the high end could see the Dax trading towards 12,498. Nevertheless, the daily resistance levels underlined on the chart should be considered.

Written By: Mahmoud Alkudsi

Please feel free to contact me on Twitter: @Malkudsi