DAX 30/CAC 40 Technical Highlights

- DAX bouncing from oversold, could set up H&S pattern later on

- CAC alleviating recent oversold, looking to fill at least one gap

For fundamental and technical forecasts, trade ideas, and educational guides, check out the DailyFX Trading Guides page.

DAX 30 bouncing from oversold, could set up H&S pattern later on

The DAX 30 sold off to the around the 200-day and June low on Tuesday, and since then it is holding so far with a bounce beginning to develop. It is helping that the world’s largest stock market – the U.S. – is finding its footing around some key support levels.

An oversold bounce at this juncture is the expected, but it is not anticipated to mature into a full-blown rally that leads back to year highs. It is still a scenario at this time, but with a bounce the prospects of a head-and-shoulders top dating back to May will come further into view.

There are a couple of gaps that could get filled along the way, with the Monday gap up to 11872 looking like it will get filled here shortly. The gap from last week could also get filled, but it will likely take a bit of time to extend up to the 12253 fill point.

A rally, though, over the 12k-mark would help post a solid-looking right shoulder, but not necessary. A weak, flattish-looking right shoulder could result as well and still set up the topping pattern all the same. For now, counter-trend longs are in play but likely to prove difficult if indeed this up move is only a retracement.

DAX 30 Daily Chart (H&S potential is there on a bounce)

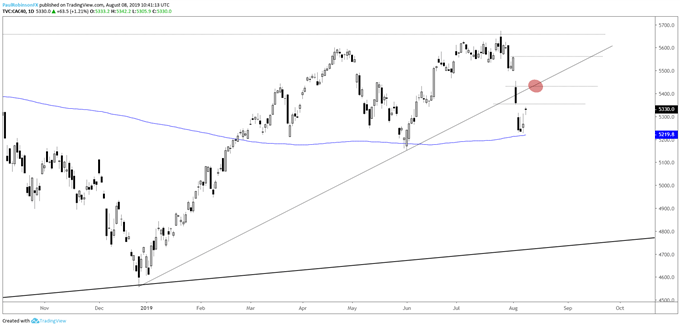

CAC alleviating recent oversold, looking to fill at least one gap

The bounce in France is taking shape with a bit more vigor so far and has the 5359 gap well in focus right now. The December trend-line will be targeted after that, followed by gap levels (see chart). The prospect of a topping pattern isn’t as clear as it is for the DAX, but if the German market does indeed top and drop the CAC will follow. Keep an eye on further developments out the DAX for cues.

CAC 40 Daily Chart (gap-fill, t-line ahead to watch)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX