DAX 30/CAC 40 Technical Highlights

To see our intermediate fundamental and technical outlook for the DAX & Euro, check out the DailyFX Q1 Forecasts.

DAX has more upside before resistance is met

The DAX finally found buyers last week and managed to post over 3% of gains on Friday. This has more upside in focus as global equity markets continue to recover from the late-year swoon. Resistance for the DAX first clocks in at the trend-line off a swing-high formed in September.

From there lies a low from November just over the 11k-mark, which depending on the timing could be in confluence with the downtrend line. This would make for the first big test in what has been an unrelenting trend for months. From a tactical standpoint, it could make for a solid spot for shorts to establish a position with defined risk.

A break above the aforementioned resistance levels would have a retest of the 2011 trend-line soon underway. Given the broad head-and-shoulders pattern triggered during Q4, it looks unlikely a rally would be able to carry beyond the 2011 trend-line.

For now, traders with short-term time-frames (intra-day to a few days) look like they will be best served focusing on a continued bounce before possibly turning bearish at higher levels.

For market sentiment and to learn more about how to use it in your analysis, check out the IG Client Sentiment page.

DAX Daily Chart (Room to go to resistance)

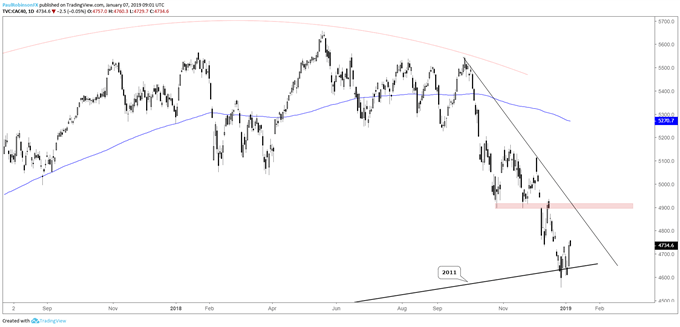

CAC to continue rally off 2011 trend-line

The CAC is coming off the 2011 trend-line and in-line with the DAX should continue to work its way higher. Similarly, to the DAX, the French index has trend-line resistance from late September to contend with along with lows from the prior to the last leg lower, near 4900. The 2011 trend-line and recent lows are considered major levels of support.

CAC Daily Chart (Bouncing from 2011 t-line)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX