DAX 30 Technical Highlights

- DAX bounce failed above neckline of H&S pattern

- Focus could soon be back on 2011 trend-line

- Trend and market tone remain in favor of sellers

For the intermediate-term fundamental and technical outlook for the DAX & Euro, check out the Q4 Trading Forecasts.

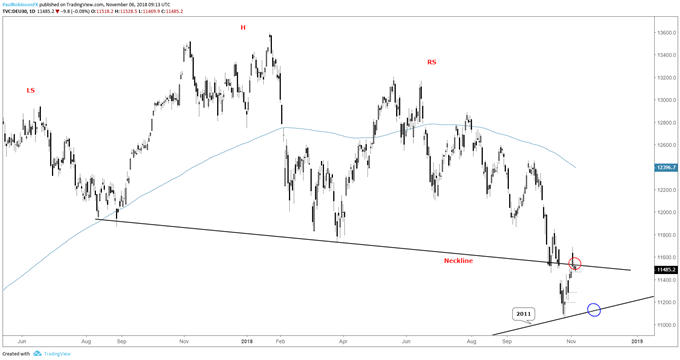

DAX bounce failed above neckline of H&S pattern

On Friday, the DAX gapped strongly higher, but with the gap came a crew of sellers which pushed the index back lower. The gap higher initially had price above the neckline of the head-and-shoulders (H&S) pattern in place since June of last year, but on a closing basis price stayed right at the key line of resistance.

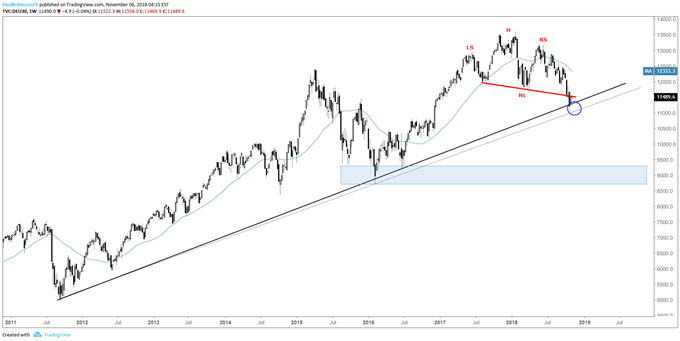

This has focus lower now, with a few gaps along the way to fill towards another test of the 2011 trend-line. It would certainly be another crucial test as the 2011 trend-line following the break of the broad H&S pattern is the only line of support keeping the DAX from falling much further down the hole.

Even if we were to see some stabilization here and the DAX trade higher above the neckline, the trend is generally negative and while it makes for sloppy trading around the break of a technical pattern, it doesn’t mean the market isn’t still headed lower.

If we were to see a strong recapture of the neckline (unlike Friday’s gap-and-trap) then we could see an advance further itself along, but, again, within the context of the trend since January any strength from here would still be viewed as corrective and likely to fail swiftly at some point.

For market sentiment and to learn more about how to use it in your analysis, check out the IG Client Sentiment page.

DAX Daily Chart (caught between the lines)

DAX Weekly Chart (H&S, 2011 trend-line)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX