DAX Technical Highlights:

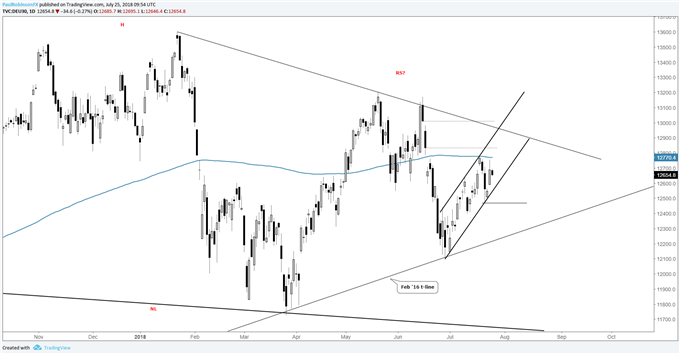

- DAX channel off June low keeping price contained

- 200-day a challenge on the top-side

- Converging trend-lines to watch on momentum-move

For the intermediate-term fundamental and technical outlook for the DAX & Euro, check out the DailyFX Q3 Forecasts.

DAX channel off June low keeping price contained

Right now, global markets are amid a soft summer rally, and this has the DAX working its way higher within the developing confines of a channel off the late-June low. We’ll use this as a guide for now: stay inside and above the July 20 low at 12469 and a bullish outlook will be maintained, break below support and the bias turns negative.

First looking at the bullish scenario. The 200-day MA last week turned out to be problematic as the DAX touched off on it to nearly the point and yesterday’s high came just shy of the long-term MA. This will be the first hurdle to overcome, followed by a gap-fill up to 12834, then another strong form of resistance by way of the trend-line running down off the record high.

Looking lower, should the channel snap and the market take out 12469, then we should see price start rolling down towards the Feb ’16 trend-line, a very important long-term threshold. A decline below there would once again bring into play the prospect of seeing the long-term head-and-shoulders pattern coming full circle.

For now, abiding by the channel and levels not far ahead and below. That’s the long and short of it until the landscape changes.

Check out this guide to learn 4 core tenets for Building Confidence in Trading.

DAX Daily Chart (Using Channel as Guidance)

For live weekly updates on the DAX and other indices, join me live on Tuesdays for ‘Indices and Commodities for the Active Trader’.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX