What’s inside:

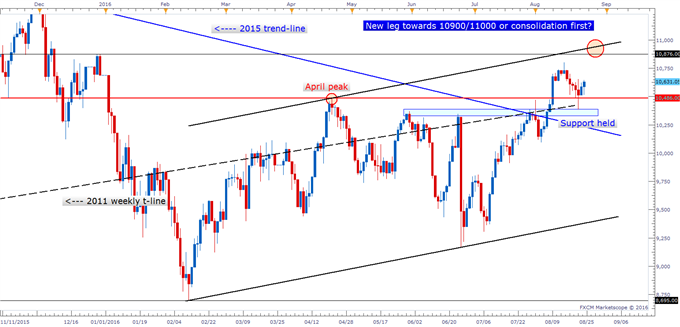

- DAX trying to bounce after hold of support on Monday

- Could be in for another leg higher towards target, but consolidation may occur first

- As long as key intermediate and long-term support holds, then so does upward bias

In Tuesday’s commentary, we made note of the rejection at significant support to start the week. The DAX experienced a little pop yesterday, and today, thus far, is finding a bit of additional follow-through after starting off on a negative note.

This bounce could develop into another leg higher into our projected target zone of 10900/11000, or a period of consolidation could begin to unfold as the 1600+ point rally off the post-Brexit low takes some time to digest. Given the intermediate and long-term levels the DAX cleared in recent weeks, a consolidation, or ‘time correction’, could bode well for the index as we head into one of the busiest parts of the year.

The focus for now is on support; as long as the market can stay above then there is no reason to doubt the current trend off the late June lows. It would require a sharp turn lower and close below the multitude of support levels before we would need to turn neutral to bearish.

To recap, support consists of the 2011 trend-line the DAX spent much of the year beneath, the 2015 trend-line overtaken earlier in the month, and the April, May, and June peaks crossed. We also can’t forget about the inverse H&S pattern and long-term bull-flag, while not the prettiest, which were triggered on the early month thrust higher.

DAX Daily

To conclude, the trading in the short-run may be choppy, but as long as support maintains, then so does the upward bias. Cross below, regardless of the reasoning, then our bias will shift with the market’s momentum.

---Written by Paul Robinson, Market Analyst

You can follow Paul at @PaulRobinsonFX.