What’s inside:

- BoE made an aggressive move, but had little impact on risk appetite outside of the UK

- Bounce in the DAX viewed as likely short-lived

- Important support and resistance levels outlined

On Thursday, the BoE cut rates to 0.25% from 0.5% (which was expected), but also expanded its QE program by another £60 billion (not expected) and left the door open for further easing measures. This gave UK stocks a shot in the arm, with the FTSE 100 responding by rallying from in the red to up 1.6% to finish the day, and undermined the pound by a couple hundred pips. The ‘euphoria’ was isolated, though, as the impact on risk appetite was not felt in any significant way in the rest of Europe and the U.S.

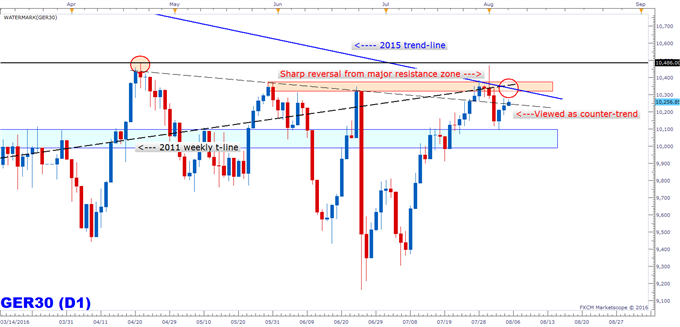

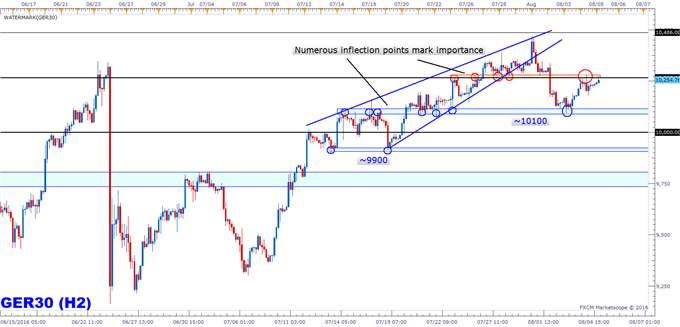

In yesterday’s piece, we took a look at the DAX and noted the bounce from short-term support as likely to be short-lived given the strong thrust lower to start the week and month and headwinds the index faces in the form of resistance, whether it be at 10265 (visible on intra-day time-frames) or a little higher on a retest of a very significant long-term trend-line, roughly in the mid-10300s.

The DAX is starting today off once again pressing up against the important short-term area around 10265. Should it begin to roll-over from here, we will look for a move back to support around 10100, and then down around 10k and 9900 on further weakness. If the DAX can take out the first area of resistance, though, we will turn to the 2015 trend-line around 10325/50 before looking for the market to stall and roll back over.

Volatility alert: Later in the session, at 12:30 GMT, the monthly U.S. jobs report will be released. Estimates are for the U.S. economy to have added 180k new jobs during July, while the unemployment rate is expected to tick lower to 4.8% from 4.9% in June. Average hourly earnings are anticipated to remain at a growth rate of 2.6% YoY. No predictions on this end, but if the jobs report deviates strongly from expectations then volatility can be expected across the risk spectrum.

Improve your skills with technical analysis by checking out one of our free trading guides.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX.

He can be reached via email at instructor@dailyfx.com ith any questions or comments.