Talking Points

- The trend is bullish above the February 29 low of 9330 and price may reach the January 27 high of 9931.

- Global stock markets are bullish as the ISM Mfg. beat the Bloomberg News poll by rising to 49.5 vs. the 48.5 expected.

See the DailyFX Analysts' 1Q forecasts for the Dollar, Euro, Pound, Equities and Gold

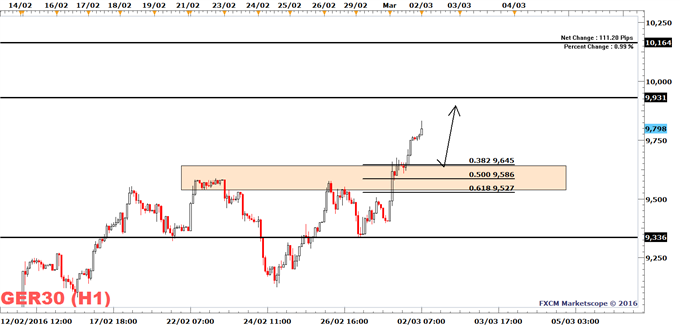

The DAX 30 (FXCM: GER30) breached last week’s high of 9594 and appears to be on its way to the January 27 high of 9931, which is also the next resistance in line.

Traders who did not buy on the break to the 9594 high will probably be tempted to do so if the DAX 30 decides to trade back to the breakout level. The bullish trend will remain intact as long as the February 29 low of 9330 holds as a support.

The January 27 high of 9931 is the likely target for bullish traders and if traders were to lift price above this level, the January 13 high of 10,164 will likely enter the fray.

U.S. ADP Employment On Deck

The DAX 30’s trend will probably remain upwards as long as the U.S. ADP Employment Change meets the expectation of the 190,000 new jobs that have been created (Bloomberg news poll). Traders will also keep an eye on the weekly U.S. Crude Oil Inventories report and a Bloomberg consensus report projects an inventory build of 3.4m barrels.

Crude oil (FXCM: USOIL) is short-term bullish above Monday’s low of $32.25 and its bullish drift should support global stock markets. In the evening the Fed will publish its ‘Beige book.’

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar