The DAX has remained muted despite the Bank of Japan (BoJ) lowering its deposit by 20bp to -10bp and the ECB also now expected to cut its deposit rate further at the next meeting.

This hesitant behavior is not evident in the FTSE 100 and Dow, which are far more bullish. If correlations to the Dow and FTSE 100 hold up, the DAX should be trading at around 10,000.

One reason for the DAX lagging may be the outlook for the world economy and the manufacturing sector in particular. This makes today interesting as the U.S. ISM Manufacturing Index is on tap. A Bloomberg news consensus poll projects an outcome of 48.5 from 48.2 in December and a rise or stable outcome is probably needed for traders to buy the DAX 30.

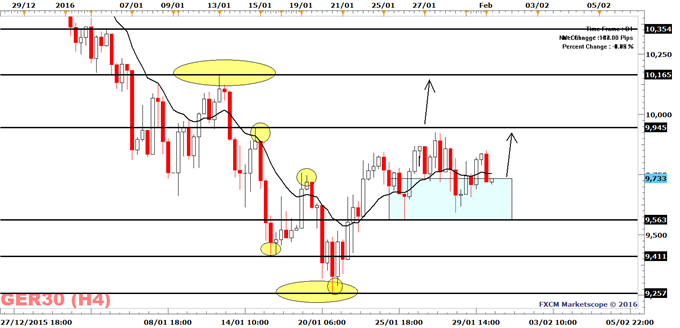

From a technical point of view, the trend is bullish above the January 26 low of 9563 and the risk/reward ratio favors long positions at current levels. The DAX may reach last week’s high of 9945 and the January 13 high of 10,165, so long as it trades above 9563. A break to 9563 will turn the short-term trend bearish, and the DAX may reach the psychological level of 9411.

Learn What FXCM’s Most Successful Traders Do on a Consistent Basis, sign up for our free guide here.

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar