The bullish outlook for the German DAX 30 (FXCM: GER30) is stronger after the Bank of Japan (BoJ) lowered its deposit by 20bp to -10bp, adopting negative interest rates in a surprise move overnight. This has boosted risk-appetite, the Japanese Yen, and Japanese stock market (FXCM: JPN225).

It’s hard to assess how much the DAX may rise, but prior experiences of monetary easing in Japan have tended to boost stock markets a great deal. The ECB is also expected to cut its deposit rate further at the next meeting and with this in mind, a risk/reward ratio approach and trend following perspective, I would favour the more bullish side.

Losing Money Trading? This Might Be Why

Technical outlook

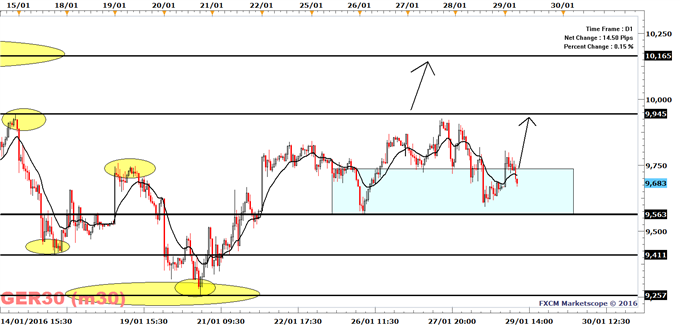

The trend is bullish above the January 26 low of 9563 and given therisk/reward ratio I suspect that traders may add to their long exposure at current levels. The DAX may reach this week’s high of 9945 and the January 13 high of 10,165, as long as it trades above 9563. A break to 9563 will turn the short-term trend bearish, and the DAX may reach the psychological level of 9411.

NEW: Boost your trading skills and pick up one of our 16 different Trading Guides

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar