Talking Points

- DAX remains bearish below Thursday’s high of 9949, however, caution is warranted after lack of bearish price action on the soft Chinese data and the better than expected German ZEW Index

- A break to last week’s low is my preferred scenario

Learn What FXCM’s Most Successful Traders Do on a Consistent Basis, sign up for our free guide here.

The DAX 30 (FXCM: GER30) is short-term bearish as long as it trades below Thursday’s high of 9949, and as long as it continues to do so, may well reach last week’s low of 9411.

A break to last week’s low may trigger a slide to the September low of 9307, while a break to this level may open the door for a decline to the November 2014 low of 9166. This bearish scenario seems fair in light of Chinese GDP rising by the weakest pace since 2009. GDP rose by 6.8% YoY vs. the 6.9% estimated, with Chinese Industrial Production rising by 5.9% YoY vs. an estimated 6% (Bloomberg News). Retail Sales on the other hand rose by 11.1% YoY vs. an estimated 11.3%.

Caution with Bearish Bets

Yet, despite this batch of soft Chinese data, the DAX 30 did not trade lower andthe Chinese stock market index, the CSI 300, has now stabilized. We have also seen higher copper prices and in short: most of the assets which were sold off during the risk-off period since late December have stabilized today.

With this in mind I think it’s fair to expect the DAX 30 to remain stable to bullish today. Out of the technical setups mentioned above, a break to last week’s low triggering a slide to the September low of 9307 is the most interesting scenario. Abreak to this low will align price action with the latest batch of macro data.

German ZEW Index Slides

The German ZEW Expectations index slid to 10.2 from 16.1 in January. This was slightly better than the 8 projected by a Bloomberg survey. The Current Situation index rose to 59.7 from 55 and beat the 53.1 expected. This gives the DAX a slightly bullish bias today and strengthens the case that bearish bets should be handled with caution.

There is no further data on tap today.

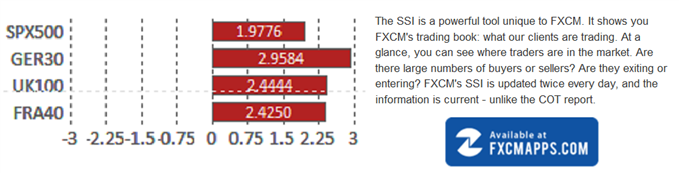

The FXCM SSI index shows traders are net-long the GER30. As the SSI is a contrarian indicator it suggests that the DAX may slide in the coming days. You may download this app for free via FXCMApps.com.

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar

Get Alejandro’s daily market update in your inbox, please fill out this form