British Pound Outlook:

- The British Pound is finishing one of the worst times of the year per seasonality studies, and given that context, the month of May has been quite good.

- GBP/JPY and GBP/USD rates are hovering below key resistance levels, while EUR/GBP rates may continue to drift higher.

- Recent changes in retail trader positioning suggest a mostly mixed bias for the British Pound.

Sterling Grinding Sideways

The British Pound has seemingly been stuck in the mud for the past few weeks, masking what has otherwise been a strong month of May. In fact, considering that Sterling is finishing one of the worst times of the year per seasonality studies, the British Pound’s gain are that much more impressive. Even if the major GBP-crosses have appeared to have tired in the last half of May, they remain generally well-positioned to capitalize on bullish technical opportunities in the coming periods.

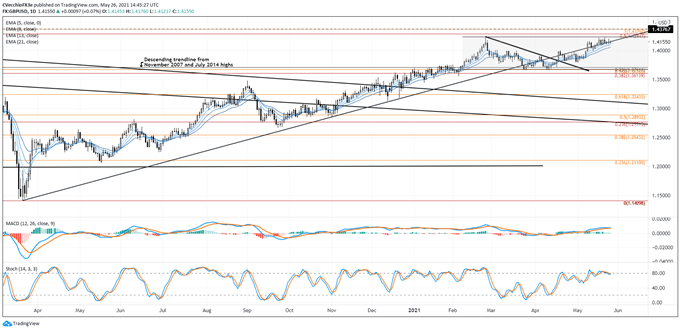

GBP/USD RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to May 2021) (CHART 1)

GBP/USD rates continue to make slow but steady progress higher as they continue to make their way to the base of the descending triangle formation that formed from mid-February to mid-April. The pair continues to hug the ascending trendline from the March and November 2020 lows, the pandemic uptrend, not quite ready to decide if it will become support or resistance.

But there is technical evidence that GBP/USD posture has bullish leanings. GBP/USD rates are treating the daily EMA envelope as support throughout May, suggesting demand remains. Daily MACD continues to hold above its signal line while moving sideways, and daily Slow Stochastics are hovering on the precipice of overbought territory. It remains the case that “more gains may be ahead as the pair seeks to reclaim the base of the aforementioned descending triangle as well as the yearly high at 1.4241.”

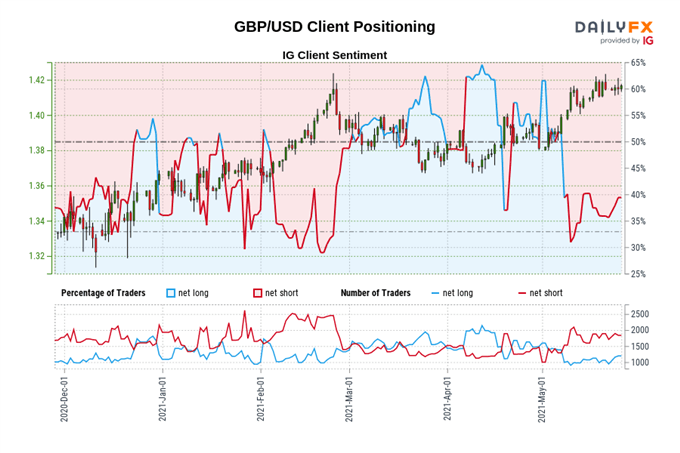

IG Client Sentiment Index: GBP/USD RATE Forecast (May 26, 2021) (Chart 2)

GBP/USD: Retail trader data shows 39.40% of traders are net-long with the ratio of traders short to long at 1.54 to 1. The number of traders net-long is 3.02% higher than yesterday and 11.62% higher from last week, while the number of traders net-short is 4.25% lower than yesterday and 12.12% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

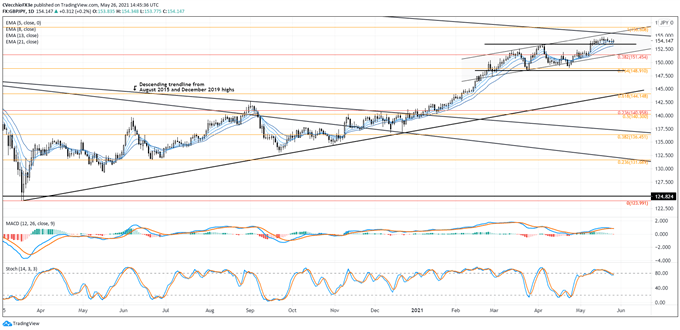

GBP/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (MARCH 2020 to May 2021) (CHART 3)

GBP/JPY rates remain the most bullish among the three GBP-crosses mentioned in this report. The pair is basing above the former yearly high set at the start of April. The daily EMA envelope has converged with the former high at 153.41, which also was the daily bearish key reversal candle high on April 6; this suggests that trend support has move above a critical turning point.

Daily MACD, while trending lower, remains above its signal line, but daily Slow Stochastics have turned higher into overbought territory. “A rally to the 2020 high at 156.61 may be soon approaching” remains the prime point of view.

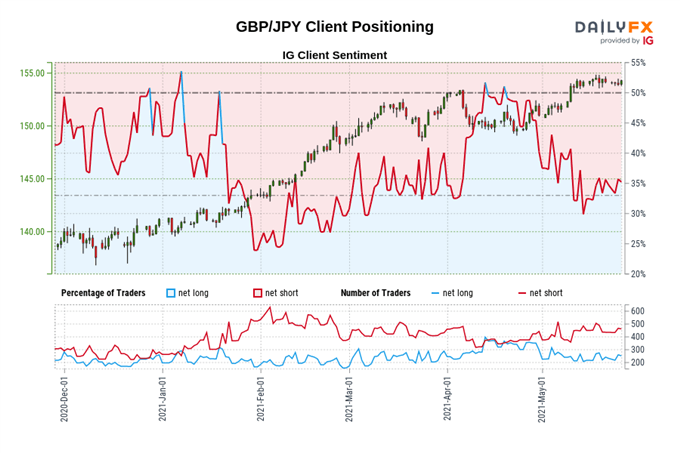

IG Client Sentiment Index: GBP/JPY Rate Forecast (May 26, 2021) (Chart 4)

GBP/JPY: Retail trader data shows 36.72% of traders are net-long with the ratio of traders short to long at 1.72 to 1. The number of traders net-long is 9.67% lower than yesterday and 13.14% lower from last week, while the number of traders net-short is 6.38% higher than yesterday and 3.91% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/JPY-bullish contrarian trading bias.

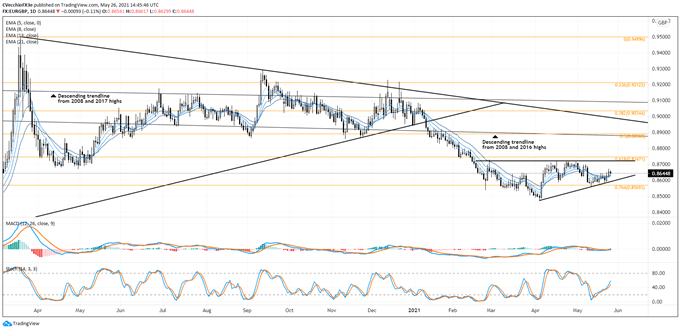

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (MARCH 2020 to May 2021) (CHART 5)

It’s been previously noted that “EUR/GBP rates have been trading into an ascending triangle, which suggests that more upside may be ahead over the next several weeks. However, the pair has extended the formation of its ascending triangle pattern, prolonging the consolidation. It may be the case that a right shoulder of an inverse head and shoulders pattern is being carved out; on the other hand, a break of the uptrend from the April and May swing lows would represent a continuation effort lower (given that the move preceding the consolidation was to the downside). It remains the case that more time needed before any decisive directional break can be determined…better opportunities may exist elsewhere.”

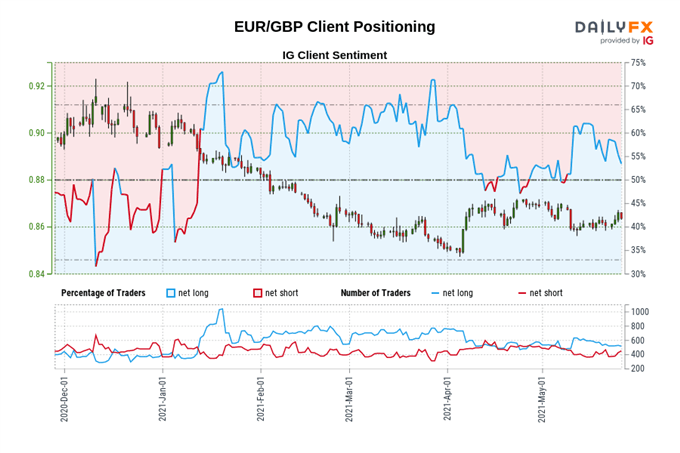

IG Client Sentiment Index: EUR/GBP Rate Forecast (May 26, 2021) (Chart 6)

EUR/GBP: Retail trader data shows 55.04% of traders are net-long with the ratio of traders long to short at 1.22 to 1. The number of traders net-long is 0.19% higher than yesterday and 4.42% lower from last week, while the number of traders net-short is 0.23% higher than yesterday and 4.33% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/GBP price trend may soon reverse higher despite the fact traders remain net-long.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist