British Pound, GBP/USD, GBP/JPY, IGCS, Bank of England – Talking Points:

- The British Pound looks set to extend gains against its haven-associated counterparts ahead of the BoE rate decision.

- GBP/USD rates perched constructively above the trend-defining 55-EMA.

- GBP/JPY tracking within the confines of an Ascending Channel.

The British Pound slid lower against its haven-associated counterparts at the end of April, on what appeared to be month-end rebalancing by market participants. With bullish technical formations still in-tact, GBP looks set to continue gaining ground against JPY and USD ahead of the Bank of England’s rate decision on May 6.

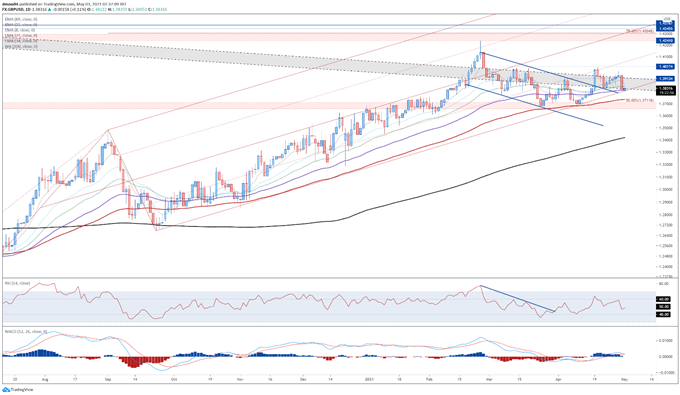

GBP/USD Daily Chart – 55-EMA Support Under Pressure

Chart prepared by Daniel Moss, created with Tradingview

The formation of a Shooting Star candle, followed by a Bearish Engulfing confirmation, suggests that GBP/USD rates could be at risk of further losses in the coming days.

However, with price continuing to track within an ascending Schiff Pitchfork, and the moving averages stacked in a bullish fashion, the path of least resistance seems higher.

Remaining constructively positioned above pitchfork parallel support and the 1.3800 handle probably opens the door for buyers to drive the exchange rate back towards the April high (1.4009), if 8-EMA resistance doesn’t stifle bullish momentum.

Alternatively, clearing the trend-defining 55-EMA (1.3816) and 1.3800 mark likely precipitates a move to test the 50% Fibonacci (1.3712).

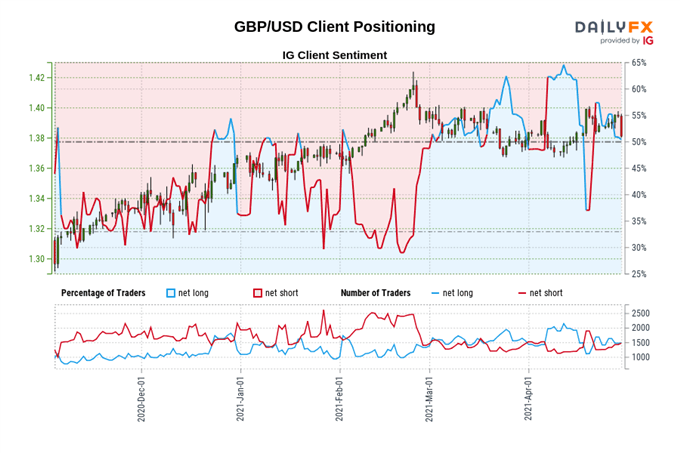

The IG Client Sentiment Report shows 58.99% of traders are net-long with the ratio of traders long to short at 1.44 to 1. The number of traders net-long is 6.05% higher than yesterday and unchanged from last week, while the number of traders net-short is 25.82% lower than yesterday and 14.43% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

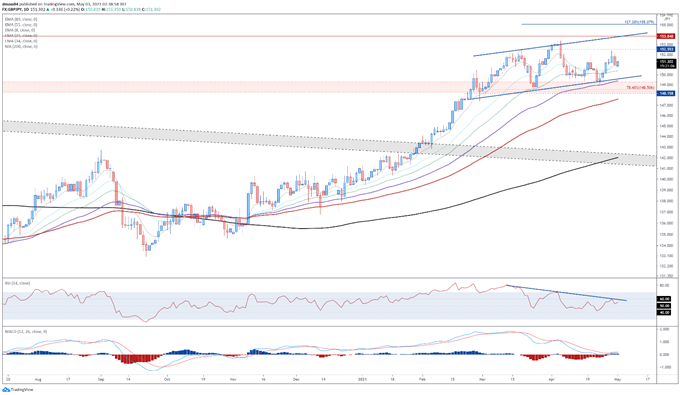

GBP/JPY Daily Chart – Ascending Channel Hints at Further Gains

Chart prepared by Daniel Moss, created with Tradingview

GBP/JPY rates, on the other hand, appear poised to continue gaining ground in the near term, as prices track within an Ascending Channel and above all six moving averages.

Indeed, with the RSI and MACD both tracking above their respective neutral midpoints, further gains look likely.

A daily close above 152.00 probably ignites a push to challenge the yearly high (153.41), with a convincing break above that bringing 153.85 into focus.

However, if sellers drive price back below the 8-EMA (150.96), a short-term pullback to the 55-EMA (149.40) and channel support may be at hand.

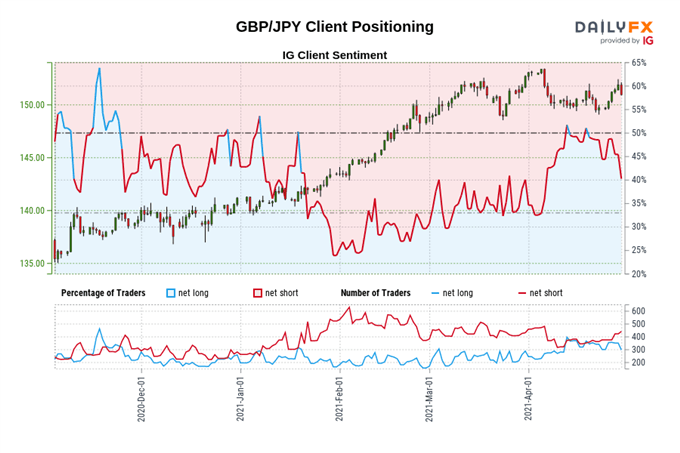

The IG Client Sentiment Report shows 36.43% of traders are net-long with the ratio of traders short to long at 1.74 to 1. The number of traders net-long is 20.07% lower than yesterday and 28.57% lower from last week, while the number of traders net-short is 4.43% lower than yesterday and 1.99% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/JPY-bullish contrarian trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss